-

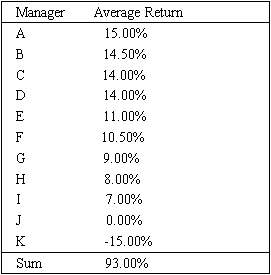

Compared to managers of traditional investments, managers of alternative investments are likely to have fewer restrictions on:

-

Compared to alternative investments, traditional investments tend to:

-

In which category of alternative investments is an investor most likely to use derivatives?

-

An investor who chooses a fund of funds as an alternative to a single hedge fund is most likely to benefit from:

-

In a leveraged buyout, covenants in leveraged loans can:

-

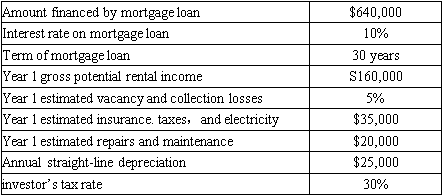

Direct commercial real estate ownership least likely requires investing in:

-

Diversification benefits from adding hedge funds to an equity portfolio may be limited because:

-

A private equity valuation approach that uses estimated multiples of cash flows to value a portfolio company is the:

-

A real estate property valuation would least likely use a (n):

-

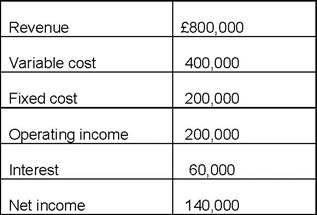

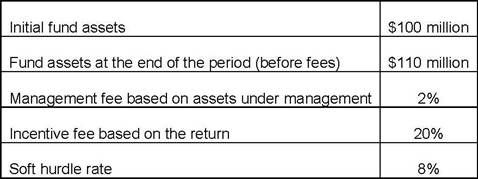

A high water mark of £150 million was established two years ago for a British hedge fund. The end-of-year value before fees for last year was £140 million. This year's end-of-year value before fees is £ 155 million. The fund charges "2 and 20." Management fees are paid independently of incentive fees and are calculated on end-of-year values. What is the total fee paid this year?

-

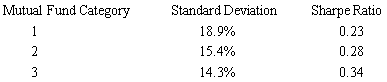

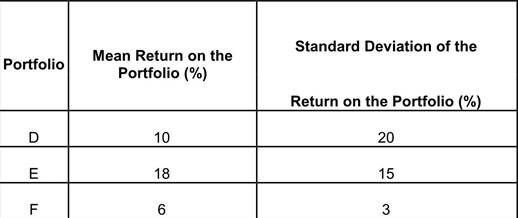

Standard deviation is least likely an appropriate measure of risk for:

-

A commodities market tends to be in backwardation if:

-

The source of return on a long-only commodity investment that represents the change in the spot price over the life of the forward or futures contract used is the:

-

For a commodity market that is in contango, an unchanged spot price over the life of a contract will result in a roll yield that is:

-

A manager following a long-only commodity index strategy is least likely to adjust the portfolio:

-

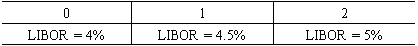

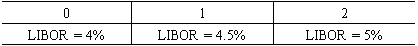

Which of the following is least likely a similarity between a forward rate agreement based on LIBOR + 1.5% and an interest rate option on LIBOR?

-

Adam Vernon took a long position in four 100-ounce July gold futures contracts at 685 when spot gold was 670. Initial margin is $4,000 per contract and maintenance margin is $3,200 per contract. If the account is marked to market when spot gold is 660 and the futures price is 672, the additional margin the investor must deposit to keep the position open is closest to:

-

The value of a call option on a stock is least likely to increase as a result of:

-

Kurt Crawford purchased shares of Acme, Inc., for $38 and sold call options at $40, covering all his shares for $2 each. The sum of the maximum per-share gain and maximum per-share loss (as an absolute value) on the covered call position is:

-

Craig Grant has entered into a $10 million quarterly-pay equity swap based on the NASDAQ stock index as the 8% fixed rate payer when the index is at 2,750.

Which of the following is most accurate?

-

It is least likely that a forward contract on a zero-coupon bond:

-

Survivorship bias in reported hedge fund index returns will most likely result in index:

-

A hedge fund with a 2 and 20 fee structure has a hard hurdle rate of 5%. If the incentive fee and management fee are calculated independently and the management fee is based on beginning-of-period asset values, an investor's net return over a period during which the gross value of the fund has increased 22% is closest to.

-

Measures of downside risk for asset classes with asymmetric return distributions are least likely to include:

-

The type of real estate index that most likely exhibits sample selection bias is a (n):

-

Which of the following most accurately describes a derivative security?

A derivative:

-

Which of the following statements about exchange-traded derivatives is least accurate?

-

A customized agreement to purchase a certain T-bond next Thursday for $1,000 is:

-

A swap is:

-

A call option gives the holder:

-

Arbitrage prevents:

-

Derivatives are least likely to provide or improve:

-

The short in a deliverable forward contract:

-

On the settlement date of a forward contract:

-

Which of the following statements regarding early termination of a forward contract is most accurate?

-

A dealer in the forward contract market:

-

Which of the following statements regarding equity forward contracts is least accurate?

-

Which of the following statements regarding forward contracts on 90-day T-bills is most accurate?

-

A Eurodollar time deposit:

-

One difference between LIBOR and Euribor is that:

-

Which of the following statements regarding a LIBOR-based FRA is most accurate?

-

Consider a $2 million FRA with a contract rate of 5% on 60-day LIBOR. If 60-day LIBOR is 6% at settlement, the long will:

-

Party A has entered a currency forward contract to purchase €10 million at an exchange rate of $0.98 per euro. At settlement, the exchange rate is $0.97 per euro. If the contract is settled in cash, Party A will:

-

If the quoted discount yield on a 128-day, $1 million T-bill decreases from 3.15% to 3.07%, how much has the holder of the T-bill gained or lost?

-

90-day LIBOR is quoted as 3.58%. How much interest would be owed at maturity for a 90-day loan of $1.5 million at LIBOR + 1.3%?

-

A company treasurer needs to borrow 10 million euros for 180 days, 60 days from now. The type of FRA and the position he should take to hedge the interest rate risk of this transaction are: FRA Position

-

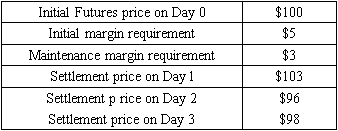

Which of the following statements about futures markets is least accurate?

-

The daily process of adjusting the margin in a futures account is called:

-

A trader buys (takes a long position in) a Eurodollar futures contract ($1 million face value) at 98.14 and closes it out at a price of 98.27. On this contract, the trader has:

-

In the futures market, a contract does not trade for two days because trades are not permitted at the equilibrium price. The market for this contract is:

-

The existence of a delivery option with respect to Treasury bond futures means that the:

-

Assume the holder of a long futures position negotiates privately with the holder of a short futures position to accept delivery to close out both the long and short positions. Which of the following statements about the transaction is most accurate? The transaction is:

-

A conversion factor in a Treasury bond contract is:

-

Three 125,000 euro futures contracts are sold at a price of $1.0234. The next day the price settles at $1.0180. The mark-to-market for this account changes the previous day's margin by:

-

In the futures market, the clearinghouse is least likely to:

-

Funds deposited to meet a margin call are termed:

-

Compared to forward contracts, futures contracts are least likely to be:

-

Which of the following statements about moneyness is least accurate? When:

-

Which of the following statements about American and European options is most accurate?

-

Which of the following statements about put and call options is least accurate?

-

Which of the following statements about options is most accurate?

-

A decrease in the risk-free rate of interest will:

-

A $40 call on a stock trading at $43 is priced at $5. The time value of the option is:

-

Prior to expiration, an American put option on a stock:

-

The owner of a call option on oil futures with a strike price of $68.70:

-

A call option sells for $4 on a $25 stock with a strike price of $30. Which of the following statements is least accurate?

-

An investor buys a put on a stock selling for $60, with a strike price of $55 for a $5 premium. The maximum gain is:

-

Which of the following is the riskiest single-option transaction?

-

An investor will likely exercise a put option when the price of the stock is:

-

A put with a strike price of $75 sells for $10. Which of the following statements is least accurate? The greatest:

-

At expiration, the value of a call option must equal:

-

An investor writes a covered call on a $40 stock with an exercise price of $50 for a premium of $2. The investor's maximum:

-

Which of the following combinations of options and underlying investments have similarly shaped profit/loss diagrams? A:

-

An analyst observes a 5-year, 10% coupon bond with semiannual payments. The face value is £ 1,000. How much is each coupon payment?

-

A 20-year, 10% annual-pay bond has a par value of $1,000. What would this bond be trading for if it were being priced to yield 15 % as an annual rate?

-

An analyst observes a 5-year, 10% semiannual-pay bond. The face amount is £1,000. The analyst believes that the yield to maturity for this bond should be 15%. Based on this yield estimate, the price of this bond would be:

-

Two bonds have par values of $1,000. Bond A is a 5% annual-pay, 15-year bond priced to yield 8% as an annual rate; the other (Bond B) is a 7.5% annual-pay, 20-year bond priced to yield 6% as an annual rate. The values of these two bonds would be:

Bond A Bond B

-

Bond A is a 15-year, 10.5% semiannual-pay bond priced with a yield to maturity of 8%, while Bond B is a 15-year, 7% semiannual-pay bond priced with the same yield to maturity. Given that both bonds have par values of $1,000, the prices of these two bonds would be:

Bond A Bond B

-

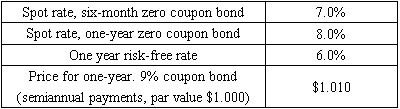

Treasury spot rates (expressed as semiannual-pay yields to maturity) are as follows: 6 months = 4%, 1 year = 5%, 1.5 years = 6%. A 1.5-year, 4% Treasury note is trading at $965. The arbitrage trade and arbitrage profit are:

-

A $1, 000, 5%, 20-year annual-pay bond has a yield of 6.5%. If the yield remains unchanged, how much will the bond value increase over the next three years?

-

The value of a 17-year, zero-coupon bond with a maturity value of $100,000 and a semiannual-pay yield of 8.22% is closest to:

-

Based on semiannual compounding, what would the YTM be on a 15-year, zero-coupon, $1,000 par value bond that's currently trading at $331.40?

-

An analyst observes a bond with an annual coupon that's being priced to yield 6.350%. What is this issue's bond equivalent yield?

-

An analyst determines that the cash flow yield of GNMA Pool 3856 is 0.382% per month. What is the bond equivalent yield?

-

If the YTM equals the actual compound return an investor realizes on an investment in a coupon bond purchased at a premium to par, it is least likely that:

-

The 4-year spot rate is 9.45%, and the 3-year spot rate is 9.85%. What is the 1-year forward rate three years from today?

-

An investor purchases a bond that is putable at the option of the holder. The option has value. He has calculated the Z-spread as 223 basis points. The option-adjusted spread will be:

-

A bond's nominal spread, zero-volatility spread, and option-adjusted spread will all be equal for a coupon bond if:

-

The zero-volatility spread will be zero:

-

Assume the Treasury spot-rate yield curve is upward sloping. Compared to the nominal yield spread between a Treasury bond and an option-free corporate bond of similar maturity, the Z-spread will be:

-

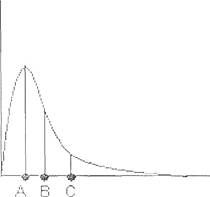

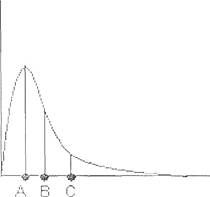

Why is the price/yield profile of a callable bond less convex than that of an otherwise identical option-free bond? The price:

-

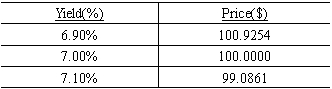

The 4.65% semiannual-pay Portage Health Authority bonds have exactly 17 years to maturity and are currently priced to yield 4.39%. Using the full valuation approach, the interest rate exposure (in percent of value) for these bonds, given a 75 basis point increase in required yield, is closest to:

-

A 14% semiannual-pay coupon bond has six years to maturity. The bond is currently trading at par. Using a 25 basis point change in yield, the effective duration of the bond is closest to:

-

Suppose that the bond in Question 3 is callable at par today. Using a 25 basis point change in yield, the bond's effective duration assuming that its price cannot exceed 100 is closest to:

-

The modified duration of a bond is 7.87. The percentage change in price using duration for a yield decrease of 110 basis points is closest to:

-

A bond has a convexity of 57.3. The convexity effect if the yield decreases by 110 basis points is closest to:

-

Assume a bond has an effective duration of 10.5 and a convexity of 97.3. Using both of these measures, the estimated percentage change in price for this bond, in response to a decline in yield of 200 basis points, is closest to:

-

An analyst has determined that if market yields rise by 100 basis points, a certain high-grade corporate bond will have a convexity effect .of 1.75%. Further, she's found that the total estimated percentage change in price for this bond should be -13.35%. Given this information, it follows that the bond's percentage change in price due to duration is:

-

The total price volatility of a typical noncallable bond can be found by:

-

The current price of a $1, 000, 7-year, 5.5% semiannual coupon bond is $1,029.23. The bond's PVBP is closest to:

-

The effect on a bond portfolio's value of a decrease in yield would be most accurately estimated by using:

-

An analyst has noticed lately that the price of a particular bond has risen less when the yield falls by 0.1% than the price falls when rates increase by 0.1%. She could conclude that the bond:

-

Which of the following measures is lowest for a currently callable bond?

-

Expected loss can decrease with an increase in a bond's:

-

Absolute priority of claims in a bankruptcy might be violated because:

-

"Notching" is best described as a difference between a (n):

-

Which of the following statements is least likely a limitation o f relying on ratings from credit rating agencies?

-

Ratio analysis is most likely used to assess a borrower's:

-

Higher credit risk is indicated by a higher:

-

Compared to other firms in the same industry, an issuer with a credit rating of AAA should have a lower:

-

Credit spreads tend to widen as:

-

Compared to shorter duration bonds, longer duration bonds:

-

One key difference between sovereign bonds and municipal bonds is that sovereign issuers:

-

An estimate of the price change for an option-free bond caused by a 1% decline in its yield to maturity based only on its modified duration will result in an answer that:

-

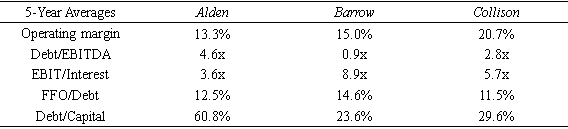

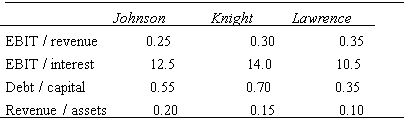

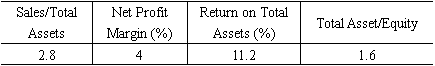

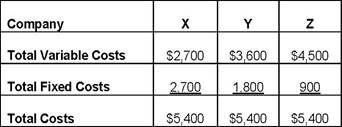

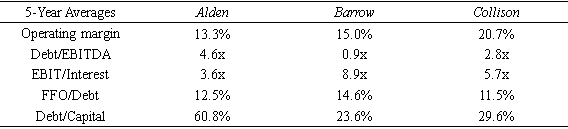

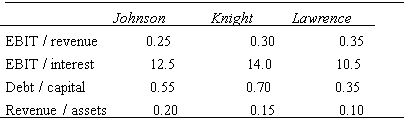

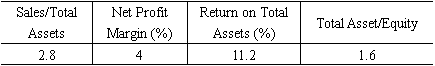

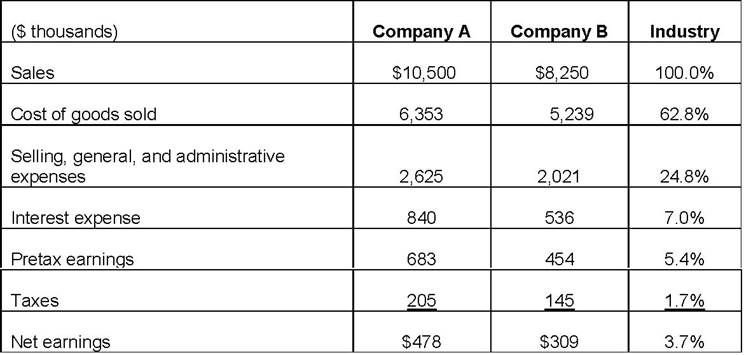

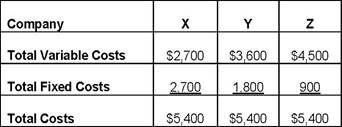

Three companies in the same industry have exhibited the following average ratios over a 5-year period:

Based only on the information given, the company that is expected to have the highest credit rating is:

-

Which statement about the theories of the term structure of interest rates is most accurate?

-

Which of the following is least likely a common form of external credit enhancement?

-

A bond with an embedded put option has a modified duration of 7, an effective duration of 6 and a convexity of 62.5. If interest rates rise 25 basis points, the bond's price will change by approximately:

-

Which of the following bonds would be the best one to own if the yield curve shifts down by 50 basis points at all maturities?

-

Which of the following provisions would most likely decrease the yield to maturity on a debt security?

-

Other things equal, a corporate bond's yield spread is likely to be most volatile if the bond is rated:

-

The effects of a decrease in interest rate (yield) volatility o n the market yield of a debt security with a prepayment option and on a debt security with a put option are most likely a (n):

Prepayment option Put option

-

Bond A has an embedded option, a nominal yield spread to Treasuries of 1.6%, a zero-volatility spread of 1.4%, and an option-adjusted spread of 1.2%. Bond B is identical to Bond A except that it does not have the embedded option, has a nominal yield spread to Treasuries of 1.4%, a zero-volatility spread of 1.3%, and an option-adjusted spread of 1.3%. The most likely option embedded in Bond A, and the bond that is the better value, are:

Embedded option Better value

-

A bank loan department is trying to determine the correct rate for a 2-year loan to be made two years from now. If current implied Treasury effective annual spot rates are: 1-year = 2%, 2-year = 3%, 3-year = 3.5%, 4-year = 4.5%, the base (risk-free) forward rate for the loan before adding a risk premium is closest to:

-

Compared to mortgage passthrough securities, CMOs created from them most likely have:

-

The arbitrage-free approach to bond valuation most likely:

-

Which of the following statements least accurately describes a form of risk associated with investing in fixed income securities?

-

A bond's indenture:

-

A bond has a par value of $5,000 and a coupon rate of 8.5% payable semiannually. What is the dollar amount of the semiannual coupon payment?

-

From the perspective of the bondholder, which of the following pairs of options would add value to a straight (option-free) bond?

-

A 10-year bond pays no interest for three years, then pays $229.25, followed by payments of $35 semiannually for seven years and an additional $1,000 at maturity. This bond is a:

-

Consider a $1 million semiannual-pay, floating-rate issue where the rate is reset on January 1 and July 1 each year. The reference rate is 6-month LIBOR, and the stated margin is +1.25%. If 6-month LIBOR is 6.5% on July 1, what will the next semiannual coupon be on this issue?

-

Which of the following statements is most accurate with regard to floating-rate issues that have caps and floors?

-

An investor paid a full price of $1,059.04 each for 100 bonds. The purchase was between coupon dates, and accrued interest was $23.54 per bond. What is each bond's clean price?

-

Which of the following statements is most accurate with regard to a call provision?

-

Which of the following most accurately describes the maximum price for a currently callable bond?

-

An investor buying bonds on margin:

-

Which of the following is least likely a provision for the early retirement of debt by the issuer?

-

A mortgage is least likely.

-

A bond with a 7.3% yield has a duration of 5.4 and is trading at $985. If the yield decreases to 7.1%, the new bond price is closest to:

-

If interest rate volatility increases, which of the following bonds will experience a price decrease?

-

A noncallable, AA-rated, 5-year zero-coupon bond with a yield of 6% is least likely to have:

-

The current price of a bond is 102.50. If interest rates change by 0.5%, the value of the bond price changes by 2.50. What is the duration of the bond?

-

Which of the following bonds has the greatest interest rate risk?

-

A floating-rate security will have the greatest duration:

-

The duration of a bond is 5.47, and its current price is $986.30. Which of the following is the best estimate of the bond price change if interest rates increase by 2%?

-

A straight 5% bond has two years remaining to maturity and is priced at $981.67. A callable bond that is the same in every respect as the straight bond, except for the call feature, is priced at $917.60. With the yield curve flat at 6%, what is the value of the embedded call option?

-

A straight 5% coupon bond has two years remaining to maturity and is priced at $981.6($1,000 par value). A putable bond, which is the same in every respect as the straight bond except for the put provision, is priced at 101.76 (percent of par value). With the yield curve flat at 6%, what is the value of the embedded put option?

-

Which of the following is least likely to fall under the heading of event risk with respect to fixed-income securities?

-

Which of the following 5-year bonds has the highest interest rate risk?

-

An investor is concerned about interest rate risk. Which of the following three bonds (similar except for yield and maturity) has the least interest rate risk? The bond with:

-

Which of the following statements about the risks of bond investing is most accurate?

-

Which of the following securities will have the least reinvestment risk for a long-term investor?

-

A 2-year, zero-coupon U.S. Treasury note is least likely to have:

-

A Treasury security is quoted at 97-17 and has a par value of $100,000. Which of the following is its quoted dollar price?

-

An investor holds $100,000 (par value) worth of Treasury Inflation Protected Securities (TIPS) that carry a 2.5% semiannual pay coupon. If the annual inflation rate is 3%, what is the inflation-adjusted principal value of the bond after six months?

-

An investor holds $100,000 (par value) worth of TIPS currently trading at par. The coupon rate of 4% is paid semiannually, and the annual inflation rate is 2.5%. What coupon payment will the investor receive at the end of the first six months?

-

A Treasury note (T-note) principal strip has six months remaining to maturity. How is its price likely to compare to a 6-month Treasury bill (T-bill) that has just been issued? The T-note price should be:

-

Which of the following statements about Treasury securities is most accurate?

-

Which of the following municipal bonds typically has the greater risk and is issued with higher yields?

-

A bond issue that is serviced with the earnings from a pool of Treasury securities that have been placed in escrow is called a(n):

-

Of the following, the debt securities that are most often registered according to the requirements of SEC Rule 415 (shelf registration) are:

-

A corporation issuing asset-backed securities can often improve the credit rating of the securities to above that of the issuing company by transferring the assets to a(n):

-

Which of the following is a difference between an on-the-run and an off-the-run issue? An on-the-run issue:

-

Compared to a public offering, a private placement of debt securities likely has:

-

Compared to negotiable CDs, bankers acceptances:

-

A debt security that is collateralized by a pool of the sovereign debt of several developing countries is most likely a (n):

-

Activities in the primary market for debt securities would least likely include:

-

Under the pure expectations theory, an inverted yield curve is interpreted as evidence that:

-

According to the liquidity preference theory, which of the following statements is least accurate?

-

With respect to the term structure of interest rates, the market segmentation theory holds that:

-

The most commonly used tool of the Fed to control interest rates is:

-

For two bonds that are alike in all respects except maturity, the relative yield spread is 7.14%. The yield ratio is closest to:

-

Assume the following yields for different bonds issued by a corporation:

·1-year bond: 5.50%.

·2-year bond: 6.00%.

·3-year bond: 7.00%.

If a 3-year U.S. Treasury is yielding 5%, then what is the absolute yield spread on the 3-year corporate issue?

-

Assume the following corporate yield curve:

·1-year bond: 5.00%.

·2-year bond: 6.00%.

·3-year bond: 7.00%.

If a 3-year U.S. Treasury yielding 6% is the benchmark bond, the relative yield spread on the 3-year corporate is:

-

If a U.S. investor is forecasting that the yield spread between U.S. Treasury bonds and U.S. corporate bonds is going to widen, which of the following beliefs would he be also most likely to hold?

-

For a Treasury bond and a corporate bond that are alike in all respects except credit risk, the yield ratio is 1.0833. If the yield on the corporate bond is 6.5%, the Treasury (benchmark) bond yield is closest to:

-

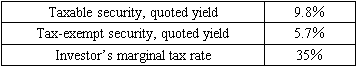

Given two bonds that are equivalent in all respects except tax status, the marginal tax rate that will make an investor indifferent between an 8.2% taxable bond and a 6.2% tax-exempt bond is closest to:

-

Which of the following statements most accurately describes the relationship between the economic health of a nation and credit spreads?

-

Which of the following most accurately describes the relationship between liquidity and yield spreads relative to Treasury issues? All else being equal, bonds with:

-

A narrowing of credit spreads would have the least impact on the value of which of the following investments?

-

Assume an investor is in the 31% marginal tax bracket. She is considering the purchase of either a 7.5% corporate bond that is selling at par or a 5.25% tax-exempt municipal bond that is also selling at par. Given that the two bonds are comparable in all respects except their tax status, the investor should buy the:

-

Which of the following best describes the benefit of cumulative share voting?

-

The advantage of participating preferred shares versus non-participating preferred shares is that participating preferred shares can:

-

Compared to public equity, which of the following is least likely to characterize private equity?

-

Global depository receipts are most often denominated in:

-

Which of the following types of preferred shares has the most risk for investors?

-

Which of the following best describes the book value of equity?

-

Which of the following causes of an increase in return on equity is most likely a positive sign for a firm's equity investors?

-

Industry classification systems from commercial index providers typically classify firms by:

-

Firms and industries are most appropriately classified as cyclical or non-cyclical based on:

-

An analyst should most likely include two firms in the same peer group for analysis if the firms:

-

The industry experience curve shows the cost per unit relative to:

-

Greater pricing power is most likely to result from greater:

-

Which of the following statements best describes the relationship between pricing power and ease of entry and exit? Greater ease of entry:

-

Industry overcapacity and increased cost cutting characterize which stage of the industry life cycle?

-

Which of the following is least likely a significant external influence on industry growth ?

-

Which of the following is least likely an element of an industry strategic analysis?

-

Which of the following best describes a low-cost competitive strategy?

-

An analyst estimates a value of $45 for a stock with a market price of $50. The analyst is most likely to conclude that a stock is overvalued if:

-

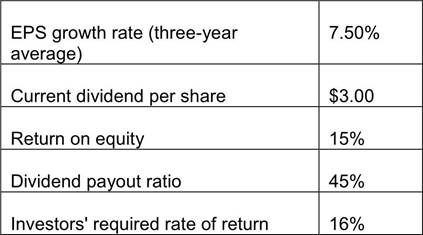

An analyst estimates that a stock will pay a $2 dividend next year and that it will sell for $40 at year-end. If the required rate of return is 15%, what is the value of the stock?

-

What would an investor be willing to pay for a share of preferred stock that pays an annual $7 dividend if the required return is 7.75%?

-

The constant growth model requires which of the following?

-

What is the intrinsic value of a company's stock if dividends are expected to grow at 5%, the most recent dividend was $1, and investors' required rate of return for this stock is 10%?

-

Next year's dividend is expected to be $2, g = 7%, and k = 12%. What is the stock's intrinsic value?

-

The XX Company paid a $1 dividend in the most recent period. The company is expecting dividends to grow at a 6% rate into the future. What is the value of this stock if an investor requires a 15% rate of return on stocks of this risk class?

-

Assume that a stock is expected to pay dividends at the end of Year 1 and Year 2 of $1.25 and $1.56, respectively. Dividends are expected to grow at a 5% rate thereafter. Assuming that ke is 11%, the value of the stock is closest to:

-

An analyst feels that Brown Company's earnings and dividends will grow at 25% for two years, after which growth will fall to a constant rate of 6%. If the projected discount rate is 10%, and Brown's most recently paid dividend was $1, the value of Brown's stock using the multistage dividend discount model is closest to:

-

A firm has an expected dividend payout ratio of 60% and an expected future growth rate of 7%. What should the firm's fundamental price-to-earnings (P/E) ratio be if the required rate of return on stocks of this type is 15%?

-

Which of the following firms would most likely be appropriately valued using the constant growth DDM?

-

Which of the following is least likely a rationale for using price multiples?

-

Which of the following firms would most appropriately be valued using an asset-based model?

-

An investor purchased 550 shares of Akley common stock for $38,500 in a margin account and posted initial margin of 50%. The maintenance margin requirement is 35%. The price of Akley, below which the investor would get a margin call, is closest to:

-

Adams owns 100 shares of Brikley stock, which is trading at $86 per share, and Brown is short 200 shares of Brikley. Adams wants to buy 100 more shares if the price rises to $90, and Brown wants to cover his short position and take profits if the price falls to $75. The orders Adams and Brown should enter to accomplish their stated objectives are:

Adams Brown

-

Which of the factors that determine the intensity of industry competition is most likely to be affected by the presence of significant economies of scale?

-

Price-to-book value ratios are most appropriate for measuring the relative value of a:

-

An index of three non-dividend paying stocks is weighted by their book values of equity. After one year, the stock with the largest weight is down 15 %, the next-largest is down 10%, and the smallest is down 5%. The total return of this index for the year is:

-

Financial intermediaries that buy securities from and sell securities to investors are best described as:

-

Among the types of assets that trade in organized markets, asset-backed securities are best characterized as:

-

Which of the following market indexes is likely to be reconstituted most frequently? An index that is designed to measure:

-

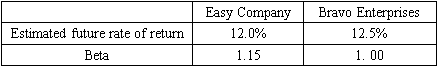

Rogers Partners values stocks using a dividend discount model and the CAPM. Holding all other factors constant, which of the following is least likely to increase the estimated value of a stock?

-

Brandy Clark, CFA, has forecast that Aceler, InC., will pay its first dividend two years from now in the amount of $1.25. For the following year she forecasts a dividend of $2.00 and expects dividends to increase at an average rate of 7% for the foreseeable future after that. If the risk-free rate is 4.5%, the market risk premium is 7.5%, and Aceler's beta is 0.9, Clark would estimate the current value of Aceler shares as being closest to:

-

An arbitrageur buys a security on a European exchange, where it is quoted in euros, and simultaneously sells the same security on a U.S. exchange, where it is quoted in dollars. The security is most likely a:

-

Under what financial market conditions can active portfolio management outperform a passive index tracking strategy consistently over time? Active management:

-

Daniel France is concerned that a long-term bond he holds might default. He therefore buys a contract that will compensate him in the case of default.

What type of contract does he hold?

-

A financial intermediary buys a stock and then resells it a few days later at a higher price. Which intermediary would this most likely describe?

-

Which of the following is most similar to a short position in the underlying asset?

-

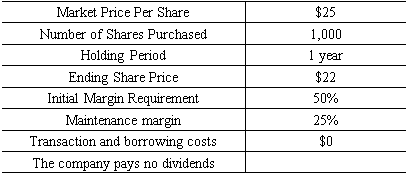

An investor buys 1,000 shares of a stock on margin at a price of $50 per share. The initial margin requirement is 40% and the margin lending rate is 3%. The investor's broker charges a commission of $0.01 per share on purchases and sales. The stock pays an annual dividend of $0.30 per share. One year later, the investor sells the 1,000 shares at a price of $56 per share. The investor's rate of return is closest to:

-

A stock is selling at $50.An investor's valuation model estimates its intrinsic value to be $40.Based on her estimate, she would most likely place a:

-

Which of the following limit buy orders would be the most likely to go unexecuted?

-

New issues of securities are transactions in the:

-

In which of the following types of markets do stocks trade any time the market is open?

-

A market is said to be informational efficient if it features:

-

Which of the following would least likely be an objective of market regulation?

-

Market float of a stock is best described as its:

-

For which of the following indexes will rebalancing occur most frequently?

-

Which of the following would most likely represent an inappropriate use of an index?

-

Which of the following is least accurate regarding fixed income indexes?

-

Most of the widely used global security indexes are:

-

In an informational efficient capital market:

-

In terms of market efficiency, short selling most likely:

-

The intrinsic value of an asset:

-

The weak-form EMH asserts that stock prices fully reflect which of the following types of information?

-

Research has revealed that the performance of professional money managers tends to be:

-

Which of the following best describes the majority of the evidence regarding anomalies in stock returns?

-

Investors who exhibit loss aversion most likely:

-

Compared to investing in a single security, diversification provides investors a way to:

-

Portfolio diversification is least likely to protect against losses:

-

In a defined contribution pension plan:

-

Low risk tolerance and high liquidity requirements best describe the typical investment needs of a(n):

-

A long time horizon and low liquidity requirements best describe the investment needs of a(n):

-

Which of the following is least likely to be considered an appropriate schedule for reviewing and updating an investment policy statement?

-

A top-down security analysis begins by:

-

Compared to exchange-traded funds (ETFs), open-end mutual funds are typically associated with lower:

-

Both buyout funds and venture capital funds:

-

Hedge funds most likely:

-

An investor buys a share of stock for $40 at time t = 0, buys another share of the same stock for $50 at t = 1, and sells both shares for $60 each at t = 2. The stock paid a dividend of $1 per share at t = 1 and at t = 2. The periodic money-weighted rate of return on the investment is closest to:

-

Which of the following asset classes has historically had the highest returns and standard deviation?

-

In a 5-year period, the annual returns on an investment are 5%, -3%, -4%,2%, and 6%. The standard deviation of annual returns on this investment is closest to:

-

A measure of how the returns of two risky assets move in relation to each other is the:

-

Which of the following statements about correlation is least accurate?

-

The standard deviation of returns is 0.30 for Stock A and 0.20 for Stock B. The covariance between the returns of A and B is 0.006. The correlation of returns between A and B is:

-

Which of the following statements about risk-averse investors is most accurate? A risk-averse investor:

-

Which of the following statements about covariance and correlation is least accurate?

-

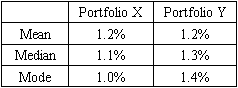

Which of the following available portfolios most likely falls below the Markowitz efficient frontier?

Portfolio Expected return Expected standard deviation

-

The capital allocation line is a straight line from the risk-free asset through the:

-

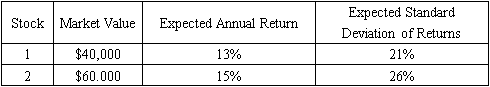

An investor put 60% of his portfolio into a risky asset offering a 10 % return with a standard deviation of returns of 8% and put the balance of his portfolio in a risk-free asset offering 5%. What is the expected return and standard deviation of his portfolio?

Expected return Standard deviation

-

What is the risk measure associated with the capital market line (CML)?

-

A portfolio to the right of the market portfolio on the CML is:

-

As the number of stocks in a portfolio increases, the portfolio's systematic risk:

-

Total risk equals:

-

A return generating model is least likely to be based on a security's exposure to:

-

The covariance of the market's returns with a stock's returns is 0.005 and the standard deviation of the market's returns is 0.05. What is the stock's beta?

-

The covariance of the market's returns with the stock's returns is 0.008. The standard deviation of the market's returns is 0.08, and the standard deviation of the stock's returns is 0.11. What is the correlation coefficient of the returns of the stock and the returns of the market?

-

According to the CAPM, what is the expected rate of return for a stock with a beta of 1.2,when the risk-free rate is 6% and the market rate of return is 12%?

-

According to the CAPM, what is the required rate of return for a stock with a beta of 0.7, when the risk-free rate is 7% and the expected market rate of return is 14%?

-

The risk-free rate is 6%, and the expected market return is 15%. A stock with a beta of 1.2 is selling for $25 and will pay a $1 dividend at the end of the year. If the stock is priced at $30 at year-end, it is:

-

A stock with a beta of 0.7 currently priced at $50 is expected to increase in price to $55 by year-end and pay a $1 dividend. The expected market return is 15%, and the risk-free rate is 8%. The stock is:

-

Which of the following statements about the SML and the CML is least accurate?

-

The investment policy statement is most accurately considered the:

-

The component of an investment policy statement that defines the investment objectives is most likely to include information about:

-

A client exhibits an above-average willingness to take risk but a below-average ability to take risk. When assigning an overall risk tolerance, the investment adviser is most likely to assess the client's overall risk tolerance as:

-

Which of the following is least likely an example of a portfolio constraint?

-

In determining the appropriate asset allocation for a client's investment account, the manager should:

-

Which of the following activities is most likely to be performed as part of the execution step of the portfolio management process?

-

A manager who evaluates portfolios' investment performance adjusted for systematic risk is most likely to rank portfolios based on their:

-

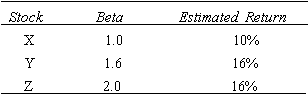

According to the capital asset pricing model:

-

Beta is best described as the:

-

According to Markowitz portfolio theory:

-

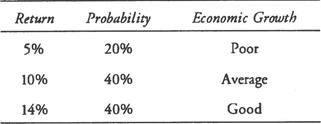

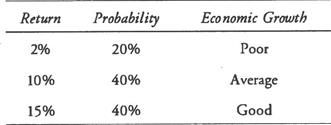

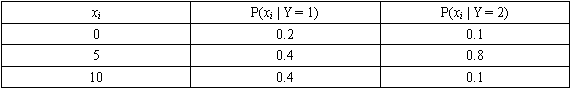

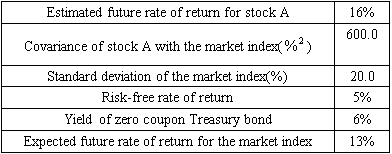

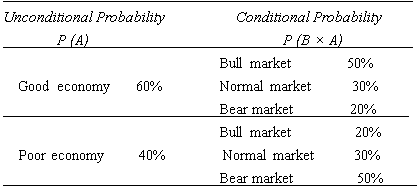

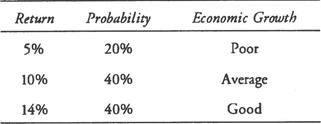

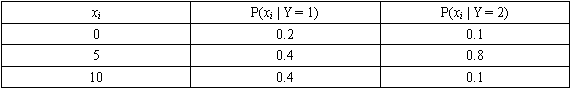

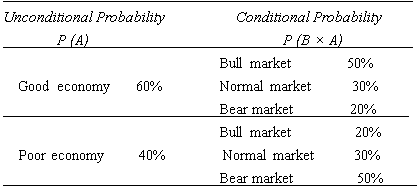

An analyst has estimated that the returns for an asset, conditional on the performance of the overall economy, are:

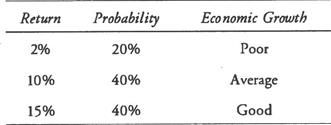

The conditional expected returns on the market portfolio are:

The conditional expected returns on the market portfolio are: According to the CAPM, if the risk-free rate is 5% and the risky asset has a beta of 1.1, with respect to the market portfolio, the analyst should:

According to the CAPM, if the risk-free rate is 5% and the risky asset has a beta of 1.1, with respect to the market portfolio, the analyst should:

-

Which of the following statements concerning the principles underlying the capital budgeting process is most accurate?

-

Which of the following statements about the payback period method is least accurate? The payback period:

-

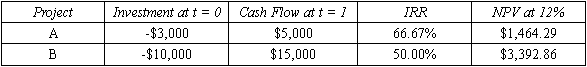

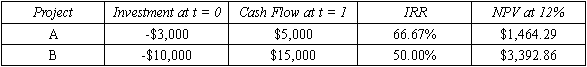

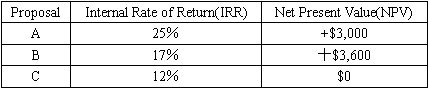

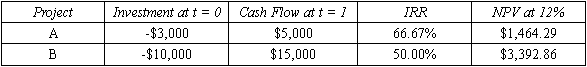

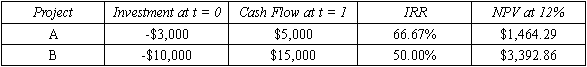

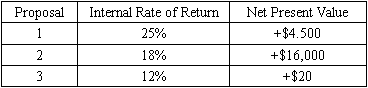

Which of the following statements about NPV and IRR is least accurate?

-

Which of the following statements is least accurate? The discounted payback period:

-

Which of the following statements about NPV and IRR is least accurate?

-

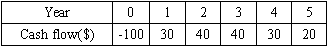

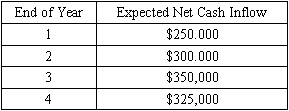

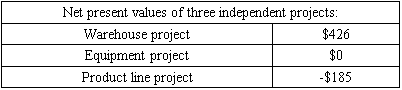

An analyst has gathered the following information about a project:

·Cost $10,000

·Annual cash inflow $4,000

·Life 4years

·Cost of capital 12%

Which of the following statements about the project is least accurate?

-

The NPV profiles of two Projects will intersect:

-

The post-audit is used to:

-

Based on surveys of comparable firms, which of the following firms “would be most likely to use NPV as its preferred method for evaluating capital projects?

-

Fallen Machinery is investing $400 million in new industrial equipment. The present value of the future after-tax cash flows resulting from the equipment is $700 million. Fallen currently has 200 million shares of common stock outstanding, with a current market price of $36 per share. Assuming that this project is new information and is independent of other expectations about the company, what is the theoretical effect of the new equipment on Fullen's stock price? The stock price will:

-

A company has $5 million in debt outstanding with a coupon rate of 12%. Currently, the yield to maturity (YTM) on these bonds is 14%. If the firm's tax rate is 40%, what is the company's after-tax cost of debt?

-

The cost of preferred stock is equal to:

-

A company's $100, 8% preferred is currently selling for $85. What is the company's cost of preferred equity?

-

The expected dividend is $2.50 for a share of stock priced at $25. What is the cost of equity if the long-term growth in dividends is projected to be 8%?

-

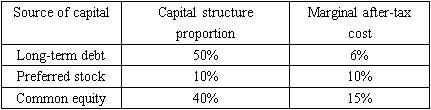

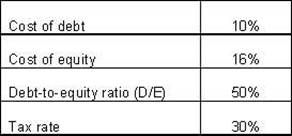

An analyst gathered the following data about a company:

Capital structure Required rate of return

30% debt 10% for debt

20% preferred stock 11% for preferred stock

50% common stock 18% for common stock

Assuming a 40% tax rate, what after-tax rate of return must the company earn on its investments?

-

A company is planning a $50 million expansion. The expansion is to be financed by selling $20 million in new debt and $30 million in new common stock. The before-tax required return on debt is 9% and 14% for equity. If the company is in the 40% tax bracket, the company's marginal cost of capital is closest to:

-

Given the following information on a company's capital structure, what is the company's weighted average cost of capital? The marginal tax rate is 40%.

Type of capital Percent of capital structure Before-tax component cost

Bonds 40% 7.5%

Preferred stock 5% 11%

Common stock 55% 15%

-

Derek Ramsey is an analyst with Bullseye Corporation, a major U.S.-based discount retailer. Bullseye is considering opening new stores in Brazil and wants to estimate its cost of equity capital for this investment. Ramsey has found that:·The yield on a Brazilian government 10-year U.S. dollar-denominated bond is 7.2%.·A 10-year U.S. Treasury bond has a yield of 4.9%.·The annualized standard deviation of the Sao Paulo Bores stock index in the most recent year is 24%.·The annualized standard deviation of Brazil's U.S. dollar-denominated 10-year government bond over the last year was 18%.·The appropriate beta to use for the project is 1.3.·The market risk premium is 6%.·The risk-flee interest rate is 4.5%.Which of the following choices is closest to the appropriate country risk premium for Brazil and the cost of equity that Ramsey should use in his analysis?Country risk premium for Brazil Cost of equity for Project

-

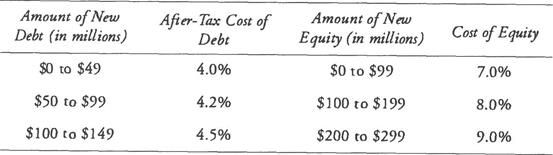

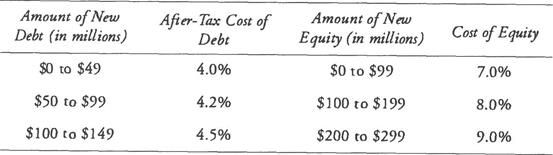

Manigault Industries currently has assets on its balance sheet of $200 million that are financed with 70% equity and 30% debt. The executive management team at Manigault is considering a major expansion that would require raising additional capital. Rosannna Stallworth, the CFO of Manigault, has put together the following schedule for the costs of debt and equity:

In a presentation to Manigault's Board of Directors, Stallworth makes the following statements:Statement 1: If we maintain our target capital structure of 70% equity and 30% debt, the break point at which our cost of equity will increase to 8.0% is $185 million in new capital.

Statement 2: If we want to finance total assets of $450 million, our marginal cost of capital will increase to 7.56%. Are Stallworth's Statements 1 and 2 most likely correct or incorrect?

Statement 1 Statement 2

-

Black Pearl Yachts is considering a project that requires a $180,000 cash outlay and is expected to produce cash flows of $50,000 per year for the next five years. Black Pearl's tax rate is 25%, and the before-tax cost of debt is 8%. The current share price for Black Pearl's stock is $56 and the expected dividend next year is $2.80 per share. Black Pearl's expected growth rate is 5%. Assume that Black Pearl finances the project with 60% equity and 40% debt, and the flotation cost for equity is 4.0%. The appropriate discount rate is the weighted average cost of capital (WACC). Which of the following choices is closest to the dollar amount of the flotation costs and the NPV for the project, assuming that flotation costs are accounted for properly?

Dollar amount of flotation costs NPV of Project

-

Jay Company has a debt-to-equity ratio of 2.0. Jay is evaluating the cost of equity for a project in the same line of business as Cass Company and will use the pure-play method with Cass as the comparable firm. Cass has a beta of 1.2 and a debt-to-equity ratio of 1.6. The project beta most likely:

-

Business risk is the combination of:

-

Which of the following is a key determinant of operating leverage?

-

Which of the following statements about capital structure and leverage is most accurate?

-

Jaycee, Inc., sells blue ink for $4 a bottle. The ink's variable cost per bottle is $2. Ink has fixed operating costs of $4,000 and fixed financing costs of $6,000. What is Jaycee's breakeven quantity of sales, in units?

-

Jaycee, Inc., sells blue ink for $4 a bottle. The ink's variable cost per bottle is $2. Ink has fixed operating costs of $4,000 and fixed financing costs of $6,000. What is Jaycee's operating breakeven quantity of sales, in units?

-

If Jaycee's sales increase by 10%, Jaycee's EBIT increases by 15%. If Jaycee' s EBIT increases by 10%, Jaycee's EPS increases by 12%. Jaycee's degree of operating leverage (DOL) and degree of total leverage (DTL) are closet to:

-

Vischer Concrete has $1.2 million in assets that are currently financed with 100% equity. Vischer's EBIT is $300,000, and its tax rate is 30%. If Vischer changes its capital structure (recapitalizes) to include 40% debt, what is Vischer's ROE before and after the change? Assume that the interest rate on debt is 5%.

ROE at 100% equity ROE at 60% equity

-

Which of the following is most likely to increase share holders' wealth?

-

Which of the following is most accurate? The purchaser of a stock will not receive the dividend if the stock was purchased on or after the:

-

A share repurchase that begins with a company communicating to shareholders a specific number of shares and a range of acceptable prices is most likely to be a(n):

-

If a company's after-tax borrowing rate is greater than the company's earning yield when the company repurchases stock with borrowed money, going forward, the earnings per share is most likely to:

-

After a share repurchase, book value per share is most likely to increase if, pre-purchase, BVPS was:

-

A company is considering either an open market share repurchase or a cash dividend of an equal amount. Compared to the open market share repurchase, the cash dividend is most likely to:

-

Studdard Controls recently declared a quarterly dividend of $1.25 payable on Thursday, April 25, to holders of record on Friday, April 12. What is the last day an investor could purchase Studdard stock and still receive the quarterly dividend?

-

Arizona Seafood, Inc., plans $45 million in new borrowing to repurchase 3,600,000 shares at their market price of $12.50. The yield on the new debt will be 12%. The company has 36 million shares outstanding and EPS of $0.60 before the repurchase. The company's tax rate is 40%. The company's EPS after the share repurchase will be closest to:

-

Northern Financial Co. has a BVPS of $5. The company has announced a $15 million share buyback. The share price is $60 and the company has 40 million shares outstanding. After the share repurchase, the company's BVPS will be closest to:

-

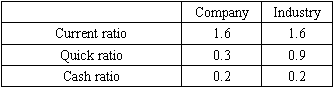

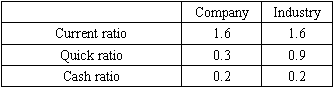

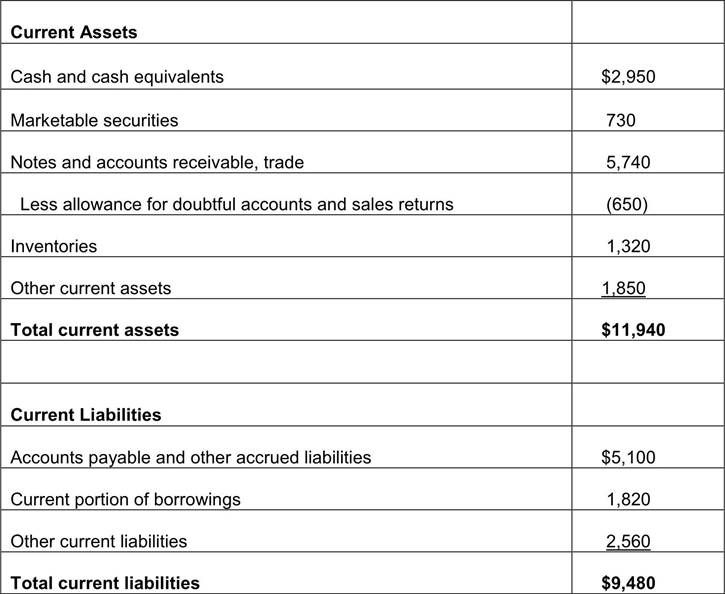

Firm A and Firm B have the same quick ratio, but Firm A has a greater current ratio than Firm B. Compared to Firm B, it is most likely that Firm A has:

-

An increase in Rowley Corp's cash conversion cycle and a decrease in Rowley's operating cycle could result from:

Cash conversion cycle  Operating cycle

Operating cycle

-

An example of a primary source of liquidity is:

-

Which of the following statements most accurately describes a key aspect of managing a firm's net daily cash position?

-

Boyle, Inc., just purchased a banker's acceptance for $25,400. It will mature in 80 days for $26,500.The discount-basis yield and the bond equivalent yield for this security are closest to:

Discount-basis Bond equivalent

-

Blonnick Corp. has found that its weighted average collection period has increased from 50 days last year to 55 days this year, and its average days of receivables this year is 48 compared to 52 last year. It is most likely that:

-

Chapmin Corp. is a large domestic services firm with a good credit rating. The source of short-term financing it would most likely use is:

-

Which of the following board characteristics would least likely be an indication of high-quality corporate governance?

-

Which of the following board members would most likely be considered well chosen based on the principles of good corporate governance?

-

Which of the following is least likely to enable a corporate board to exercise its duty by acting in the long-term interest of shareholders?

-

Which of the following would most likely be considered a negative factor in assessing the suitability of a board member? The board member:

-

Which of the following would least likely be an indication of poor corporate governance?

-

Which of the following would most likely be considered a poor corporate practice in terms of promoting shareholder interests?

-

Two analysts are discussing shareholder defenses against hostile takeovers. Alice states, “It is positive for shareholders that the board has shown a willingness to buy back shares from holders who may be in a position to effect a hostile takeover of the firm at less than its long-term value to shareholders.” Bradley states, “Firms that are likely takeover targets should offer valuable exit packages in the event of a hostile takeover because they are necessary to recruit highly talented top executives, such as the CEO.” From the perspective of good corporate governance, are these statements correct?

-

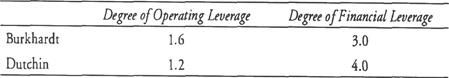

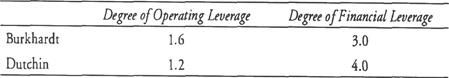

An analyst calculates the following leverage ratios for Burkhart Company and Dutchin Company:

If both companies' sales increase by 5%, what are the most likely effects on the companies' earnings before interest and taxes (EBIT) and earnings per share (EPS)?

-

Which of the following would most likely lead to an increase in a typical firm's capital investment for the current period?

-

Which of the following changes in a firm's working capital management is most likely to result in a shorter operating cycle?

-

A company's operations analyst is evaluating a plant expansion project that is likely to be financed in part by issuing new common equity. Flotation costs are expected to be 4% of the amount of new equity capital raised. The most appropriate way for the analyst to treat the flotation costs is to:

-

A board of directors is most likely to act in the long-term interest of shareholders if:

-

The manufacturer of Paw Detergent has developed New Improved Paw with Dirt eaters and is considering adding it to its product line. New Improved Paw would sell at a premium price compared to Paw. In order to manufacture New Improved Paw, the firm will need to build a new facility and purchase new equipment. Which of the following is least likely included when calculating the appropriate cash flows for analysis of whether to add New Improved Paw to its product line?

-

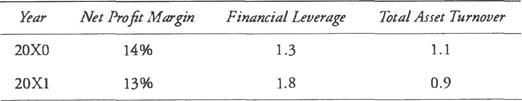

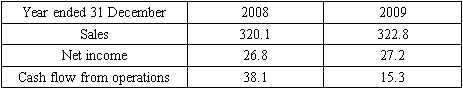

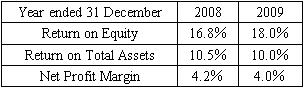

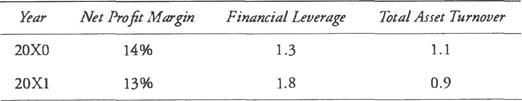

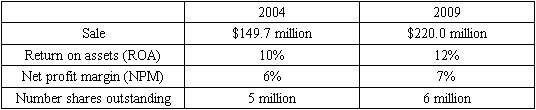

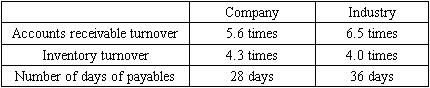

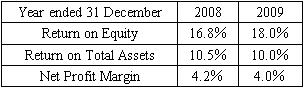

Acme Corp. has reported the following financial ratios for the past two years:

Based only on these results, an analyst would most correctly conclude that the results in year 20X1 compared to those in year 20X0 indicate that Acme's ROE has:

-

The use of secondary sources of liquidity would most likely be considered:

-

A firm's debt-to-equity ratio is most likely to increase as a result of a(n):

-

A firm is evaluating two mutually exclusive projects of the same risk class, Project X and Project Y. Both have the same initial cash outlay and both have positive NPVs. Which of the following is a sufficient reason to choose Project X over Project Y?

-

Which of the following is least likely to be a motivation to over report net income?

-

Which of the following is most likely an example of accounting fraud?

-

The "fraud triangle" consists of:

-

Competitive threats to the profitability or financial stability of a firm are best categorized as an accounting fraud risk factor related to:

-

According to Statement on Auditing Standards No.99, Consideration of Fraud in a Financial Statement Audit, which of the following is least likely to be a risk factor related to opportunities to commit fraudulent accounting?

-

Accounting fraud risk factors related to attitudes and rationalizations are least likely to include:

-

Which of the following actions is least likely to immediately increase earnings?

-

Decreasing accounts payable turnover by delaying payments to suppliers is most likely to cause cash flow from financing activities to:

-

As part of its working capital management program, Rotan Corporation has an accounts payable financing arrangement with the First National Bank. The bank pays Rotan's vendors within 30 days of the invoice date. Rotan reimburses the bank 90 days after the invoice is due. Ignoring interest, what is the most likely effect on Rotan's operating cash flow and financing cash flow when the bank is repaid?

-

In order to generate cash, Company L securitized its accounts receivable through a special purpose entity. Company M pledged its accounts receivable to a local bank in order to secure a short-term loan. Assuming Company L and Company M are identical in all other respects, which company has higher operating cash flow and which company has higher financing cash flow?

Higher operating cash flow Higher financing cash flow

-

Over the past two years, a firm reported higher operating cash flow as a result of securitizing its accounts receivable and from increasing income tax benefits from employee stock options. The tax benefits are solely the result of higher tax rates. What should an analyst conclude about the sustainability of these two sources of operating cash flow?

-

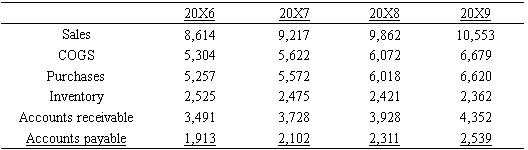

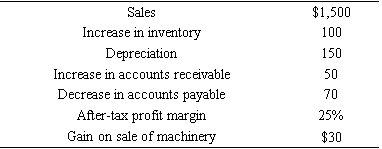

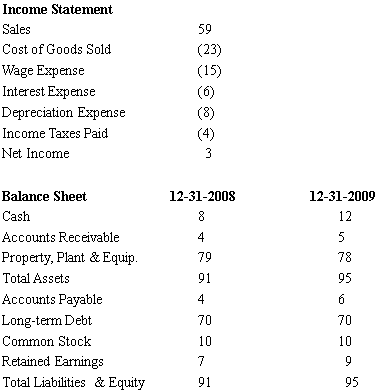

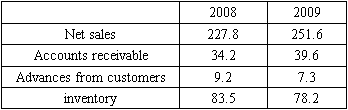

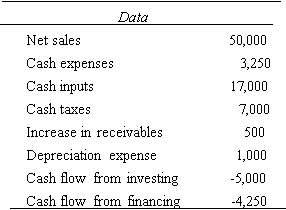

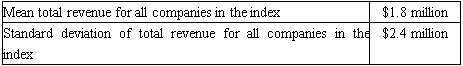

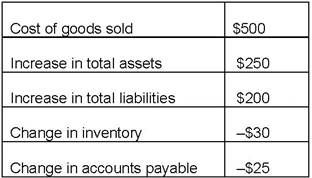

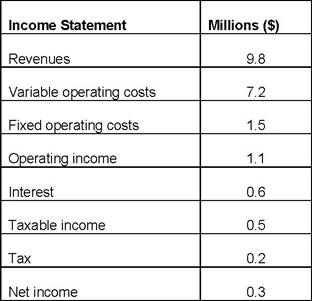

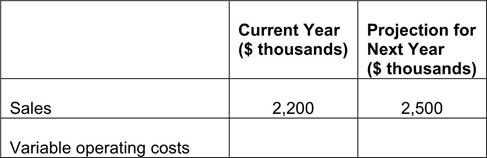

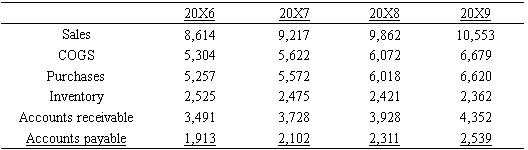

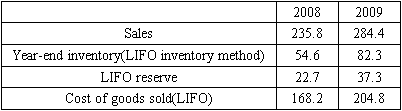

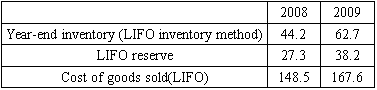

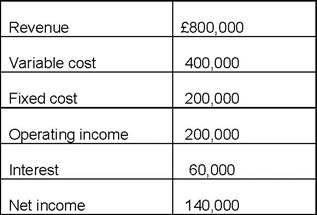

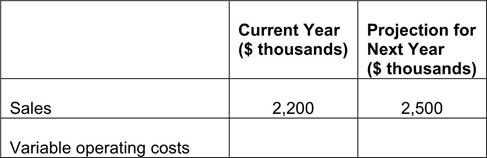

The table below shows selected data from a company's financial statements.

Based on these results, what was this company's most likely strategy for improving its operating activity during this period?

-

An analyst who is projecting a company's net income and cash flows is least likely to assume a constant relationship between the company's sales and its:

-

Credit analysts are likely to consider a company's credit quality to be improving if the company reduces its:

-

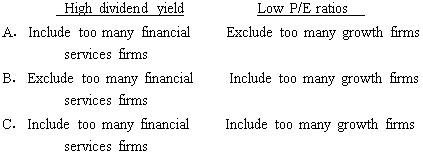

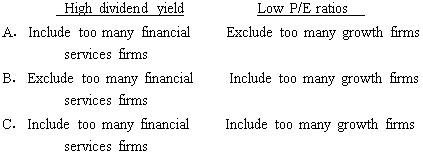

Which of the following stock screens is most likely to identify stocks with high earnings growth rates?

-

An analyst needs to compare the financial statements of Firm X and Firm Y. Which of the following differences in the two firms' financial reporting is least likely to require the analyst to make an adjustment?

Firm X Firm Y

-

When comparing a firm that uses LIFO inventory accounting to firms that use FIFO, an analyst should:

-

The ratio of a firm's property, plant, and equipment, net of accumulated depreciation, to its annual depreciation expense is best interpreted as an estimate of the

-

How should an analyst most appropriately adjust the financial statements of a firm that uses operating leases to finance its plant and equipment?

-

The fundamental qualitative characteristics of financial statements as described by the IASB conceptual framework least likely include:

-

A decrease in a firm's inventory turnover ratio is most likely to result from:

-

Two firms are identical except that the first pays higher interest charges and lower dividends, while the second pays higher dividends and lower interest charges. Both prepare their financial statements under U.S. GAAP. Compared to the first, the second will have cash flow from financing (CFF) and earnings per share (EPS) that are:

CFF EPS

-

Which of the following is an analyst least likely to be able to find on or calculate from either a common-size income statement or a common-size balance sheet?

-

If a firm's inventory turnover and number of days of payables both increase, the effect on a firm's cash conversion cycle is:

-

The following information is summarized from Famous, Inc.'s financial statements for the year ended December 31,20X0:

·Sales were $800,000.

·Net profit margin was 20%.

·Sales to assets was 50%.

·Equity multiplier is 1.6.

·Interest expense was $30,000.

·Dividends declared were $32,000

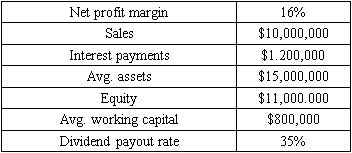

Famous, Inc.'s sustainable growth rate based on results from this period is closest to:

-

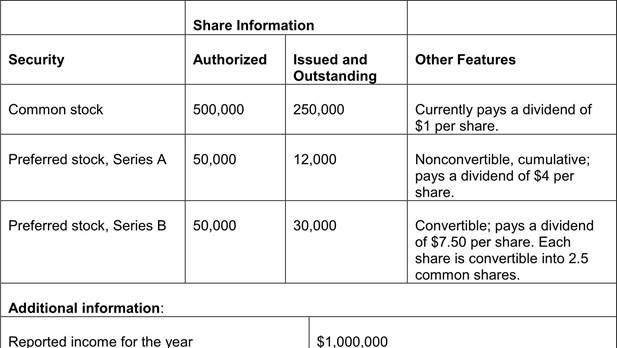

On January 1, Orange Computers issued employee stock options for 400,000 shares. Options on 200,000 shares have an exercise price of $18, and options on the other 200,000 shares have an exercise price of $22. The year-end stock price was $24, and the average stock price over the year was $20. The change in the number of shares used to calculate diluted earnings per share for the year due to these options is closest to:

-

A snowmobile manufacturer that uses LIFO begins the year with an inventory of 3,000 snowmobiles, at a carrying cost of $4,000 each. In January, the company sells 2,000 snowmobiles at a price of $10,000 each. In July, the company adds 4,000 snowmobiles to inventory at a cost of $5,000 each. Compared to using a perpetual inventory system, using a periodic system for the firm's annual financial statements would:

-

Which of the following transactions is least likely to increase reported operating cash flow for the period?

-

Train Company paid $8 million to acquire a franchise at the beginning of 20X5 that was expensed in 20X5. If Train had elected to capitalize the franchise as an intangible asset and amortize the cost of the franchise over eight years, what effect would this decision have on Train's 20X5 cash flow from operations (CFO) and 20X6 debt-to-assets-ratio?

-

Graphics, Inc. has a deferred tax asset of $4,000,000 on its books. As of December 31, it is probable that $2,000,000 of the deferred tax asset's value will never be realized because of the uncertainty about future income. Graphics, Inc. should:

-

Long-lived assets cease to be depreciated when the firm's management decides to dispose of the assets by:

-

If Lizard Inc., a lessee, treats a 5-year lease as a finance lease with straight line depreciation rather than as an operating lease:

-

In the notes to its financial statements, Gilbert Company discloses a €400,000 reversal of an earlier writedown of inventory values, which increases this inventory's carrying value to €2,000,000. It is most likely that:

-

Taking an impairment charge due to a decrease in the value of a long-lived depreciable asset is least likely, in the period the impairment is recognized, to reduce a firm's:

-

Under U.S. GAAP, firms are required to capitalize:

-

With regard to the exercise of employee stock options, which of the following is least likely a concern to the analyst?

-

A firm that purchases a building that it intends to rent out for income would report this asset as investment property using the cost model under:

-

When a company redeems bonds before they mature, the gain or loss on debt extinguishment is calculated as the bonds' carrying amount minus the:

-

Victory Corp. received interest income from federally tax exempt bonds of $40,000 in the year 20X0. Its statutory tax rate is 40%. The effect of this difference between taxable and pre-tax income is most likely a (n):

-

Under a defined contribution pension plan, which of the following is recognized as a pension expense?

-

Princeton Company calls its $1,000,000, 9% bonds for $1,010,000. On the call date, the bonds have a book value of $980,000 and unamortized issue costs of $24,000. Under U.S. GAAP, Princeton should report a:

-

An analyst is comparing two firms, one that reports under IFRS and one that reports under FASB standards. An analyst is least likely to do which of the following to facilitate comparison of the companies?

-

An analyst wants to compare the cash flows of two U.S. companies, one that reports cash flow using the direct method and one that reports it using the indirect method. The analyst is most likely to:

-

Which of the following is most likely included in a firm's ending inventory?

-

Under which inventory cost flow assumption does inventory on the balance sheet best approximate its current cost?

-

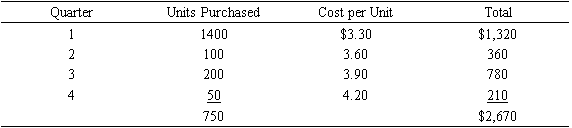

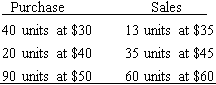

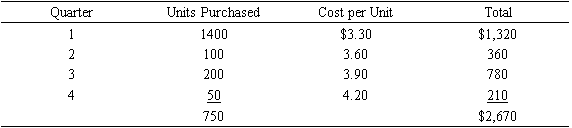

During the year, a firm's inventory purchases were as follows:

The firm uses a periodic inventory system and calculates inventory and COGS at the end of the year.·Beginning inventory was 200 units at $3 per unit = $600.

·Sales for the year were 600 units.

Compute COGS for the year under FIFO and LIFO.

FIFO LIFO

-

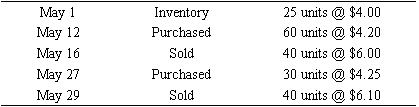

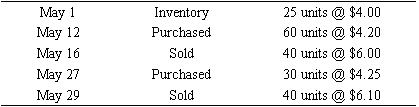

During May, a firm's inventory account included the following transactions:

Assuming periodic FIFO inventory costing, gross profit for May was:

-

In periods of rising prices and stable inventory quantities, which of the following best describes the effect on gross profit of using LIFO as compared to using FIFO?

-

Kamp, Inc. sells specialized bicycle shoes. At year-end, due to a sudden increase in manufacturing costs, the replacement cost per pair of shoes is $55. The original cost is $43, and the current selling price is $50. The normal profit margin is 10% of the selling price, and the selling costs are $3 per pair. According to U.S. GAAP, which of the following amounts should each pair of shoes be reported on Kamp's year-end balance sheet?

-

Which of the following inventory disclosures would least likely be found in the footnotes of a firm following IFRS?

-

Which of the following is most likely for a firm with high inventory turnover and lower sales growth than the industry average? The firm:

-

Red Company immediately expenses its development costs while Black Company capitalizes its development costs. All else equal, Red Company will:

-

Which of the following statements about indefinite-lived intangible assets is most accurate?

-

In the early years of an asset's life, a firm using the double-declining balance method, as compared to a firm using straight-line depreciation, will report lower:

-

East Company purchased a new truck a t the beginning of this year for $30,000. The truck has a useful life of eight years or 150,000 miles, and an estimated salvage value of $3,000. If the truck is driven 16,500 miles this year, how much depreciation will East report under the double-declining balance (DDB) method and the units-of-production (UOP) method?

DDB UOP

-

Which of the following is least likely considered in determining the useful life an intangible asset?

-

At the beginning of this year, Fair-weather Corp. incurred $200,000 of research costs and $100,000 of development costs to create a new patent. The patent is expected to have a useful life of 40 years with no salvage value. Calculate the carrying value of the patent at the end of this year, assuming Fair-weather follows U.S. GAAP.

-

Two years ago, Metcalf Corp. purchased machinery for $800,000. At the end of last year, the machinery had a fair value of $720,000. Assuming Metcalf uses the revaluation model, what amount, if any, is recognized in Metcalf's net income this year if the machinery's fair value is $810,000?

-

According to U.S. GAAP, an asset is impaired when:

-

A firm recently recognized a $15,000 loss on the sale of machinery used in its manufacturing operation. The original cost of the machinery was $100,000 and the accumulated depreciation at the date of sale was $60,000. What amount did the firm receive from the sale?

-

Which of the following disclosures would least likely be found in the financial statement footnotes of a firm?

-

Which of the following statements is most accurate? The difference between taxes payable for the period and the tax expense recognized on the financial statements results from differences:

-

Which of the following tax definitions is least accurate?

-

An increase in the tax rate causes the balance sheet value of a deferred tax asset to:

-

In its first year of operations, a firm produces taxable income of-$10,000. The prevailing tax rate is 40%. The firm's balance sheet will report a deferred tax:

-

An analyst is comparing a firm to its competitors. The firm has a deferred tax liability that results from accelerated depreciation for tax purposes. The firm is expected to continue to grow in the foreseeable future. How should the liability be treated for analysis purposes?

-

Which one of the following statements is most accurate? Under the liability method of accounting for deferred taxes, a decrease in the tax rate at the beginning of the accounting period will:

-

While reviewing a company, an analyst identifies a permanent difference between taxable income and pretax income. Which of the following statements most accurately identifies the appropriate financial statement adjustment?

-

An analyst is reviewing a company with a large deferred tax asset on its balance sheet. She has determined that the firm has had cumulative losses for the last three years and has a reduced prices. Which of the following adjustments should the analyst make to account for the deferred tax assets?

-

If the tax base of an asset exceeds the asset's carrying value and a reversal is expected in the future:

-

The author of a new textbook received a $100,000 advance from the publisher this year. $40,000 of income taxes was paid on the advance when received. The textbook will not be finished until next year. Determine the tax basis of the advance at the end of this year.

-

According to IFRS, the deferred tax consequences of revaluing held-for-use equipment upward is reported on the balance sheet:

-

KLH Company reported the following:

·Gross DTA at the beginning of the year $10,500

·Gross DTA at the end of the year $11,250

·Valuation allowance at the beginning of the year $2,700

·Valuation allowance at the end of the year $3,900

Which of the following statements best describes the expected earnings of the firm? Earnings are expected to:

-

Using the effective interest rate method, the reported interest expense of a bond issued at a premium will:

-

According to U.S. GAAP, the coupon payment on a bond is:

-

At the beginning of 20X6, Cougar Corporation enters a finance lease requiring five annual payments of $10,000 each beginning on the first day of the lease. Assuming the lease interest rate is 8%, the amount of interest expense recognized by Cougar in 20X6 is closest to:

-

Which of the following is least likely to be disclosed in the financial statements of a bond issuer?

-

As compared to purchasing a n asset, which of the following is least likely an incentive to structure a transaction as a finance lease?

-

In a defined benefit pension plan:

-

A net pension asset or net pension liability is equal to the difference between the fair value of plan assets and the expected pension obligation under:

-

At the end of last year, Maui Corporation's assets and liabilities were as follows:

·Total assets $98,500

·Accrued liabilities $5,000

·Short-term debt $12,000

·Bonds payable $39,000

Maui's debt-to-equity ratio is closest to:

-

For a nonfinancial firm, are depreciation expense and interest expense included or excluded from operating expenses in the income statement?

Depreciation expense Interest expense

-

Are income taxes and cost of goods sold examples of expenses classified by nature or classified by function in the income statement?

Income taxes Cost of goods sold

-

Which of the following is least likely a condition necessary for revenue recognition?

-

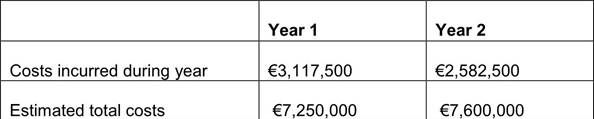

AAA has a contract to build a building for $100,000 with an estimated time to completion of three years. A reliable cost estimate for the project is $60,000. In the first year of the project, AAA incurred costs totaling $24,000. How much profit should AAA report at the end of the first year under the percentage-of-completion method and the completed-contract method?

Percentage-of-completion Completed-contract

-

Which principle requires that cost of goods sold is recognized in the same period in which the sale of the related inventory is recorded?

-

Which of the following would least likely increase pretax income?

-

When accounting for inventory, are the first-in, first-out (FIFO) and last-in, first-out (LIFO) cost flow assumptions permitted under U.S. GAAP?

FIFO LIFO

-

Which of the following best describes the impact of depreciating equipment with a useful life of 6 years using the declining balance method as compared to the straight-line method?

-

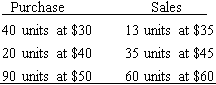

CC Corporation reported the following inventory transactions (in chronological order) for the year:

Assuming inventory at the beginning of the year was zero; calculate the year-end inventory using FIFO and LIFO.

FIFO LIFO

-

At the beginning of the year, Triple W Corporation purchased a new piece of equipment to be used in its manufacturing operation. The cost of the equipment was $25,000. The equipment is expected to be used for 4 years and then sold for $4,000. Depreciation expense to be reported for the second year using the double-declining-balance method is closest to:

-

Which of the following is least likely considered a nonoperating transaction from the perspective of a manufacturing firm?

-

Changing an accounting estimate:

-

Which of the following transactions would most likely be reported below income from continuing operations, net of tax?

-

Which of the following statements about nonrecurring items is least accurate?

-

The Hall Corporation had 100,000 shares of common stock outstanding at the beginning of the year. Hall issued 30,000 shares of common stock on May 1. On July 1, the company issued a 10% stock dividend. On September 1, Hall issued 1, 000, 10% bonds, each convertible into 21 shares of common stock. What is the weighted average number of shares to be used in computing basic and diluted EPS, assuming the convertible bonds are dilutive?

Average shares, Average shares,

basic dilutive

-

Given the following information, how many shares should be used in computing diluted EPS?

·300,000 shares outstanding.

·100,000 warrants exercisable at $50 per share.

·Average share price is $55.

·Year-end share price is $60.

-

An analyst gathered the following information about a company:

·100,000 common shares outstanding from the beginning of the year.

·Earnings of $125,000.

·1,000, 7%, $1,000 par bonds convertible into 25 shares each, outstanding as of the beginning of the year.

·The tax rate is40%.

The company's diluted EPS is closest to:

-

An analyst has gathered the following information about a company:

·50,000 common shares outstanding from the beginning of the year.

·Warrants outstanding all year on 50,000 shares, exercisable at $20 per share.

·Stock is selling at year end for $25.

·The average price of the company's stock for the year was $15.

·How many shares should be used in calculating the company's diluted EPS?

-

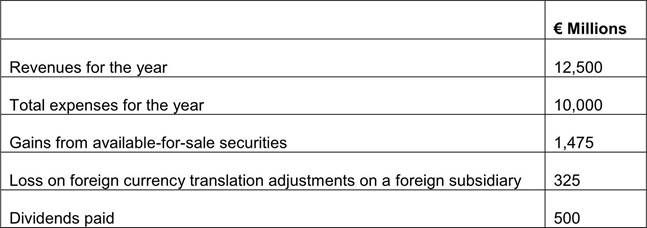

Which of the following transactions affects owners' equity but does not affect net income?

-

Which of the following is least likely to be included when calculating comprehensive income?

-

A vertical common-size income statement expresses each category of the income statement as a percentage of:

-

Which of the following would most likely result in higher gross profit margin, assuming no fixed costs?

-

Which of the following is most likely an essential characteristic of an asset?

-

Which of the following statements about analyzing the balance sheet is most accurate?

-

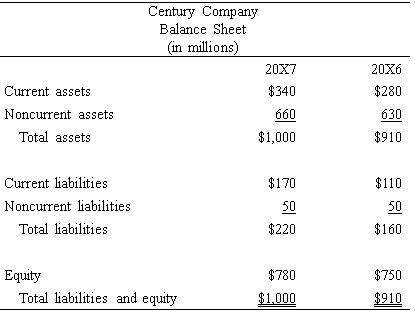

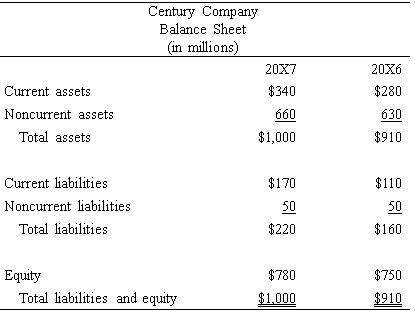

Century Company's balance sheet follows:

Century's balance sheet presentation is known as a(n)?

-

Which of the following would most likely result in a current liability?

-

How should the proceeds received from the advance sale of tickets to a sporting event be treated by the seller, assuming the tickets are nonrefundable?

-

A vertical common-size balance sheet expresses each category of the balance sheet as a percentage of:

-

Which of the following inventory valuation methods is required by the accounting standard-setting bodies?

-

SF Corporation has created employee goodwill by reorganizing its retirement benefit package. An independent management consultant estimated the value of the goodwill at $2 million. In addition, SF recently purchased a patent that was developed by a competitor. The patent has an estimated useful life of five years. Should SF report the goodwill and patent on its balance sheet?

Goodwill Patent

-

At the beginning of the year, Parent Company purchased all 500,000 shares of Sub Incorporated for $15 per share. Just before the acquisition date, Sub's balance sheet reported net assets of $6 million. Parent determined the fair value of Sub's property and equipment was $1 million higher than reported by Sub. What amount of goodwill should Parent report as a result of its acquisition of Sub?

-

Miller Corporation has 160,000 shares of common stock authorized. There are 92,000 shares issued and 84,000 shares outstanding. How many shares of treasury stock does Miller own?

-

Selected data from Alpha Company's balance sheet at the end of the year follows:

·Investment in Beta Company, at fair value $150,000

·Deferred taxes $86,000

·Common stock, $1 par value $550,000

·Preferred stock, $100 par value $175,000

·Retained earnings $893,000

·Accumulated other comprehensive income $46,000

The investment in Beta Company had an original cost of $120,000. Assuming the investment in Beta is classified as available-for-sale, Alpha's total owners' equity at year-end is closest to:

-

Which of the following ratios are used to measure a firm's liquidity and solvency?

Liquidity Solvency

-

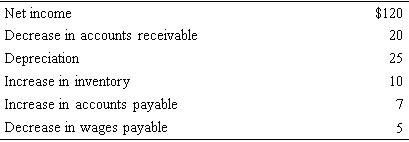

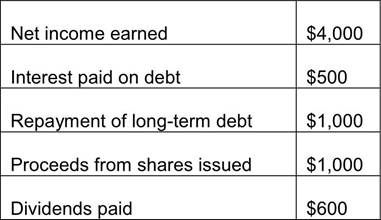

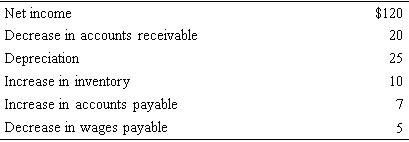

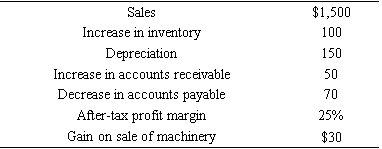

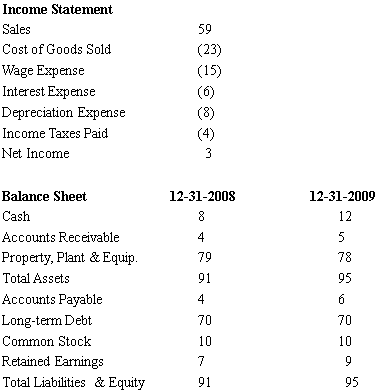

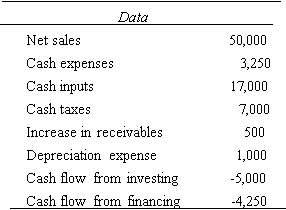

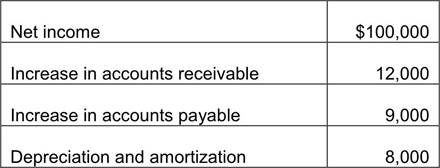

Using the following information, what is the firm's cash flow from operations?

-

Given the following:

Cash flow from operations is:

-

Which of the following items is least likely considered a cash flow from financing activity under U.S. GAAP?

-

Which of the following would be least likely to cause a change in investing cash flow?

-

Which of the following is least likely a change in cash flow from operations under U.S. GAAP?

-

Where are dividends paid to shareholders reported in the cash flow statement under U.S. GAAP and IFRS? U.S. GAAP IFRS

-

Sales of inventory would be classified as:

-

Issuing bonds would be classified as:

-

Sale of land would be classified as:

-

Under U.S. GAAP, taxes paid would be classified as:

-

An increase in notes payable would be classified as:

-

Under U.S. GAAP, interest paid would be classified as:

-

Continental Corporation reported sales revenue of $150,000 for the current year. If accounts receivable decreased $10,000 during the year and accounts payable increased $4,000 during the year, cash collections were:

-

The write-off of obsolete equipment would be classified as:

-

Sale of obsolete equipment would be classified as:

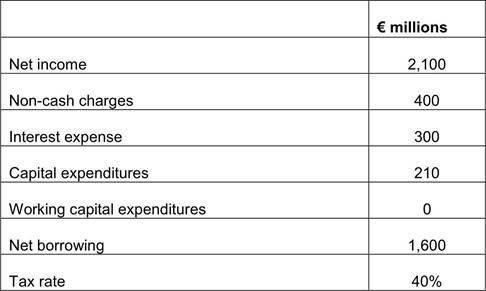

-