单选题

编号:2693147

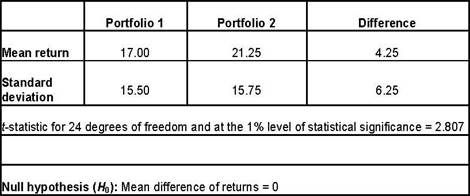

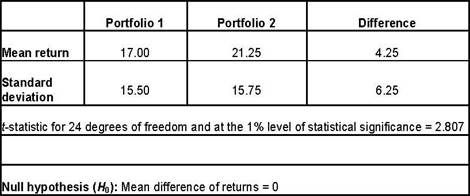

1. Using the following sample results drawn as 25 paired observations fTom their underlying distribution s, test whether the m ean retu rns of the two porte'olios differ from each other at the 1% level of statistical significance. Assume th e underlying distributions of returns for each portfolio are normal and that their population variances are not known.

Based on the paired comparisons test of the two portfolios, the most appropriate conclusion is that HL should be:

Based on the paired comparisons test of the two portfolios, the most appropriate conclusion is that HL should be: