单选题

编号:2692714

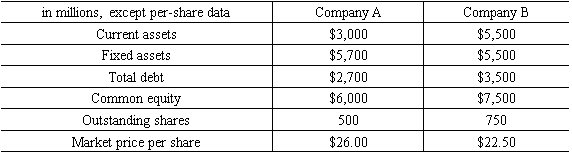

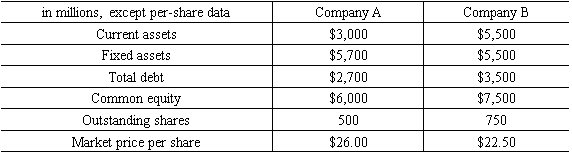

1. Falcon Financial Group is considering the purchase of Company A or Company B based on a low price-to-book investment strategy that also considers differences in solvency. Selected financial data for both firms, as of December 31,2009,as follows:

The firms' financial statement footnotes contain the following:· Company A values its inventory using the first in, first out (FIFO) method.

· Company B's inventory is based on the last in, first out (LIFO) method. Had Company B used FIFO, its inventory would have been $700 million higher.

· Company A leases its manufacturing plant. The remaining operating lease payments total $1,600 million. Discounted at 10%, the present value of the remaining payments is $1,000 million.

· Company B owns its manufacturing plant.

To make the firms financials ratios comparable, calculate the adjusted price-to-book ratios for Company A and Company B.

Company A Company B

The firms' financial statement footnotes contain the following:· Company A values its inventory using the first in, first out (FIFO) method.

· Company B's inventory is based on the last in, first out (LIFO) method. Had Company B used FIFO, its inventory would have been $700 million higher.

· Company A leases its manufacturing plant. The remaining operating lease payments total $1,600 million. Discounted at 10%, the present value of the remaining payments is $1,000 million.

· Company B owns its manufacturing plant.

To make the firms financials ratios comparable, calculate the adjusted price-to-book ratios for Company A and Company B.

Company A Company B