单选题

编号:2692342

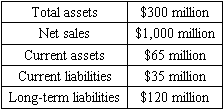

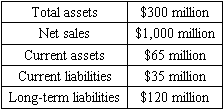

1. An analyst gathered the following information from Leneor Corporation's 2009 financial statements published:

After reviewing the footnotes to the financial statements of Leneor Corporation, the analyst concludes that the present value of operating lease payments for 2010 is $8 million and the present value of operating lease payments for all years after 2010 totals $80 million. Other companies in this industry use capitalized lease obligations dominantly. So the analyst needs to adjust the financial ratio of Leneor Corporation. Leneor Corporation's adjusted 2009 total debt-to-total capital and total asset turnover ratios, respectively, that best compare the company to the industry are:

Total debt-to-total capital ratio Total asset turnover ratio

After reviewing the footnotes to the financial statements of Leneor Corporation, the analyst concludes that the present value of operating lease payments for 2010 is $8 million and the present value of operating lease payments for all years after 2010 totals $80 million. Other companies in this industry use capitalized lease obligations dominantly. So the analyst needs to adjust the financial ratio of Leneor Corporation. Leneor Corporation's adjusted 2009 total debt-to-total capital and total asset turnover ratios, respectively, that best compare the company to the industry are:

Total debt-to-total capital ratio Total asset turnover ratio