单选题

编号:2686188

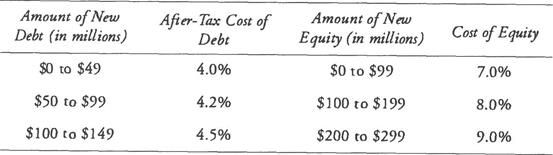

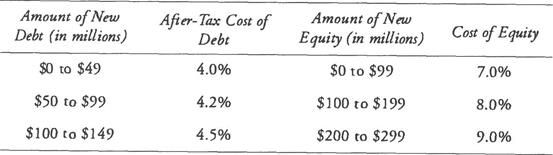

1. Manigault Industries currently has assets on its balance sheet of $200 million that are financed with 70% equity and 30% debt. The executive management team at Manigault is considering a major expansion that would require raising additional capital. Rosannna Stallworth, the CFO of Manigault, has put together the following schedule for the costs of debt and equity:

In a presentation to Manigault's Board of Directors, Stallworth makes the following statements:Statement 1: If we maintain our target capital structure of 70% equity and 30% debt, the break point at which our cost of equity will increase to 8.0% is $185 million in new capital.

Statement 2: If we want to finance total assets of $450 million, our marginal cost of capital will increase to 7.56%. Are Stallworth's Statements 1 and 2 most likely correct or incorrect?

Statement 1 Statement 2

In a presentation to Manigault's Board of Directors, Stallworth makes the following statements:Statement 1: If we maintain our target capital structure of 70% equity and 30% debt, the break point at which our cost of equity will increase to 8.0% is $185 million in new capital.

Statement 2: If we want to finance total assets of $450 million, our marginal cost of capital will increase to 7.56%. Are Stallworth's Statements 1 and 2 most likely correct or incorrect?

Statement 1 Statement 2