单选题

编号:2692373

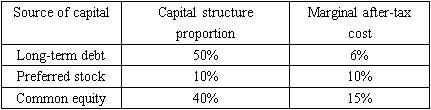

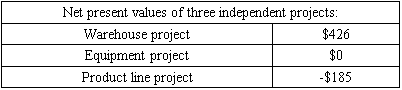

1. An analyst gathered the following information about a company that expects to fund its capital budget without issuing any additional shares of common stock:

If no significant size or timing differences exist among the projects and the projects all have the same risk as the company, which project has an internal rate of return that exceeds 10 percent?

If no significant size or timing differences exist among the projects and the projects all have the same risk as the company, which project has an internal rate of return that exceeds 10 percent?