单选题

编号:2692711

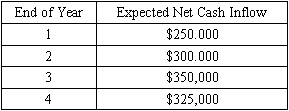

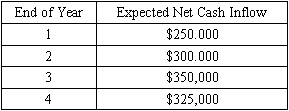

1. An analyst is investigating an investment project of Hellet Corporation. The investment project with the same risk as the company has the following expected net cash inflows during year 1 to year 4:

The company's cost of equity is 12 percent, cost of debt is 7 percent, and weighted average cost of capital is 9 percent, the risk-free rate is 5%. The maximum that the company should be willing to invest in the project is closest to:

The company's cost of equity is 12 percent, cost of debt is 7 percent, and weighted average cost of capital is 9 percent, the risk-free rate is 5%. The maximum that the company should be willing to invest in the project is closest to: