单选题

编号:2691416

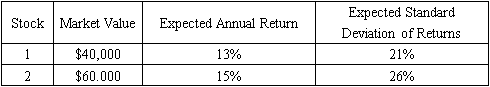

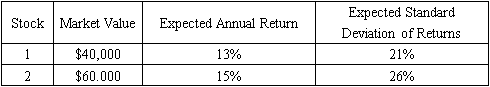

1. An investor currently holds the following portfolio of common stocks:

The expected correlation of returns between Stock 1 and Stock 2 is +0.60. The investor sells Stock 2 and uses the $60,000 proceeds to purchase another stock that has the same expected annual return and standard deviation of returns as Stock 2, but has an expected correlation of returns with Stock 1 of +0.55. Will the investor's action increase the portfolio's expected:

annual return? standard deviation of return?

The expected correlation of returns between Stock 1 and Stock 2 is +0.60. The investor sells Stock 2 and uses the $60,000 proceeds to purchase another stock that has the same expected annual return and standard deviation of returns as Stock 2, but has an expected correlation of returns with Stock 1 of +0.55. Will the investor's action increase the portfolio's expected:

annual return? standard deviation of return?