单选题

编号:2686166

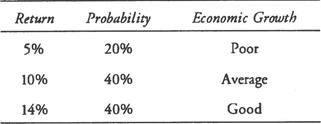

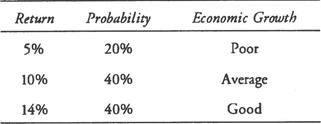

1. An analyst has estimated that the returns for an asset, conditional on the performance of the overall economy, are: The conditional expected returns on the market portfolio are:

The conditional expected returns on the market portfolio are: According to the CAPM, if the risk-free rate is 5% and the risky asset has a beta of 1.1, with respect to the market portfolio, the analyst should:

According to the CAPM, if the risk-free rate is 5% and the risky asset has a beta of 1.1, with respect to the market portfolio, the analyst should:

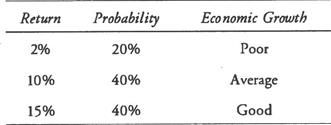

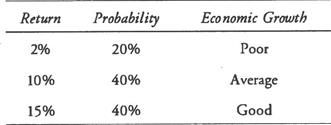

The conditional expected returns on the market portfolio are:

The conditional expected returns on the market portfolio are: According to the CAPM, if the risk-free rate is 5% and the risky asset has a beta of 1.1, with respect to the market portfolio, the analyst should:

According to the CAPM, if the risk-free rate is 5% and the risky asset has a beta of 1.1, with respect to the market portfolio, the analyst should: