单选题

编号:2692392

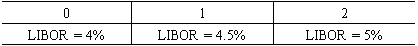

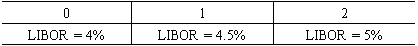

1. A U.S. bank enters into a plain vanilla currency swap with a notional principal of US$500 million (GBP£300 million). At each settlement date, the U.S. bank” pays a fixed rate of 4.5 percent on the British pounds received and the British bank pays a variable rate equal to LIBOR on the U.S. dollars received. Given the following information, what payment is made to whom at the end of year 2? The U.S. bank pays:

The U.S. bank pays:

The U.S. bank pays:

The U.S. bank pays: