单选题

编号:2693651

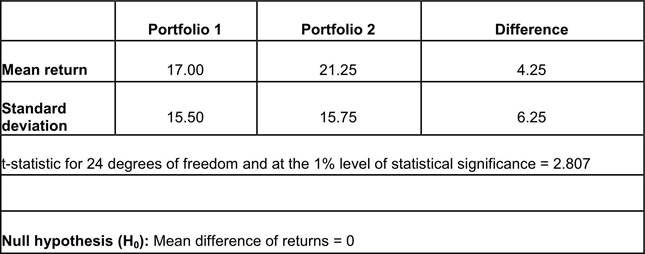

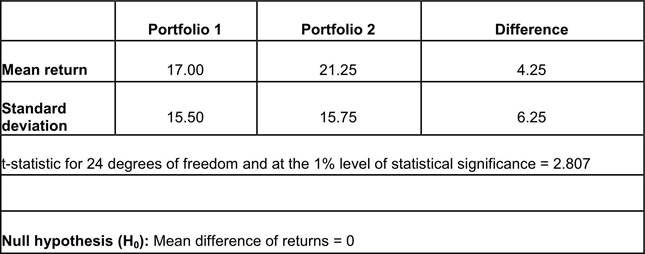

1. Using the following sample results drawn as 25 paired observations from their underlying istributions, test whether the mean returns of the two portfolios differ from each other at the 1% evel of statistical significance. Assume the underlying distributions of returns for each portfolio are normal and that their population variances are not known.

Based on the paired comparisons test of the two portfolios, the most appropriate conclusion is that H0 should be:

Based on the paired comparisons test of the two portfolios, the most appropriate conclusion is that H0 should be: