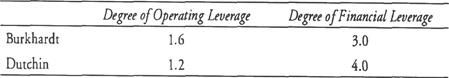

1. An analyst calculates the following leverage ratios for Burkhart Company and Dutchin Company:

If both companies' sales increase by 5%, what are the most likely effects on the companies' earnings before interest and taxes (EBIT) and earnings per share (EPS)?