-

Based on put-call parity for European options, a synthetic put is most likely equivalent to a:

-

If the implied volatility for options on a broad-based equity market index goes up, then it is most likely that:

-

Which statement best describes option price sensitivities? The value of a:

-

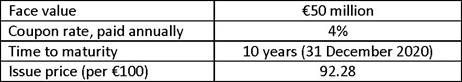

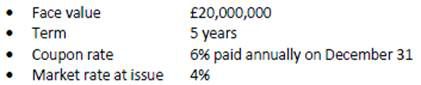

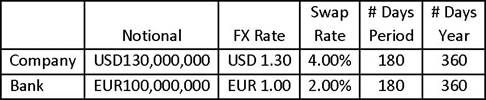

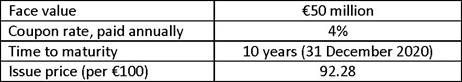

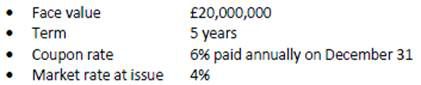

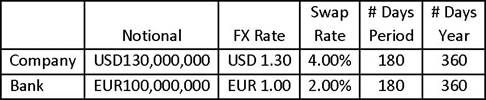

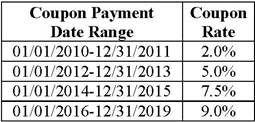

A European company issues a five-year euro-denominated bond with a face value of EUR50,000,000. The company then enters into a five-year currency swap with a bank to convert the EUR exposure into USD exposure. The notional principals of the swap are EUR50,000,000 and USD70,000,000. The European company pays a fixed rate of 5%, and the bank pays a fixed rate of 4.5%. Payments are made semiannually on a basis of 30 days per month and 360 days per year. The payment from the bank to the company at the end of Year 4 is closest to:

-

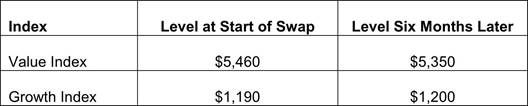

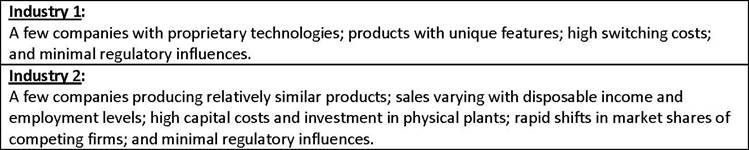

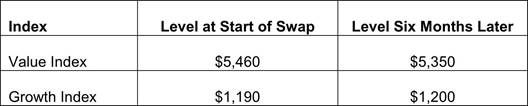

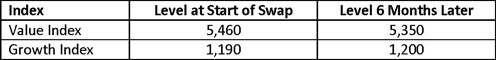

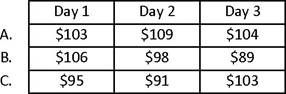

A portfolio manager enters into an equity swap with a swap dealer. The portfolio manager agrees to pay the return on the Value Index and receive the return on the Growth Index. The swap's notional principal is $50 million, and the payments will be made semi-annually. The levels of the equity indices are as follows:

The net amountowedtothe portfolio manager aftersix monthsis closest to:

-

An industry experiencing slow growth, high prices, and volumes insufficient to achieve economies of scale is most likely in the:

-

Which of the following statements concerning different valuation approaches is most accurate?

-

According to behavioral finance, observed overreaction in securities markets most likely occurs because of:

-

A corporate manager pursuing a low-cost strategy will most likely:

-

A trader buys 500 shares of a stock on margin at $36 a share using an initial leverage ratio of 1.66. The maintenance margin requirement for the position is 30%. The stock price at which the margin call will occur is closest to:

-

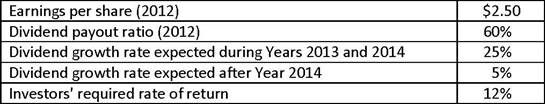

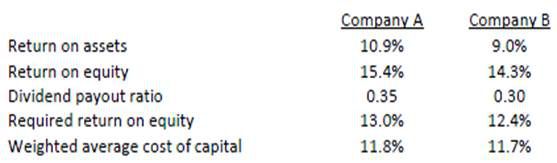

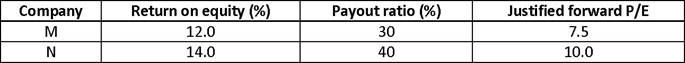

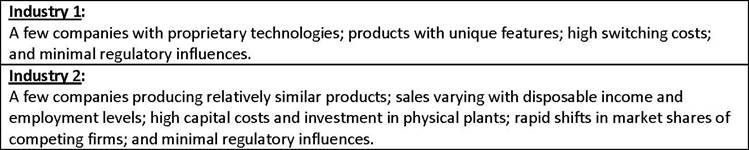

An equity analyst follows two industries with the following characteristics:

Industry 1 :

A few companies with proprietary technologies, products with unique features, high switching costs, and minimal regulatory influences.

Industrv 2:

A few companies producing relatively similar products, sales varying with disposable income and employment levels, high capital costs and investment in physical plants, rapid shifts in market shares of competing firms, and minimal regulatory influences.

Based on the above information, the analyst will most appropriately conclude that, compared with the firms in Industry 2, those in Industry 1 would potentially have:

-

A trader seeking to sell a very large block of stock for her client will most likely execute the trade in a(n):

-

The Gordon growth model is most appropriate for valuing the common stock of a dividend paying company that is:

-

Which of the following statements is least accurate? A firm's free cash flow to equity (FCFE):

-

An observation that stocks with above average price-to-earnings ratios have consistently underperformed those with below average price-to-earnings ratios least likely contradicts which form of market efficiency?

-

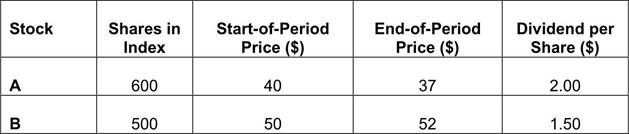

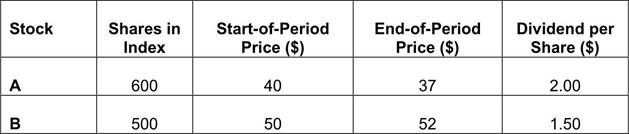

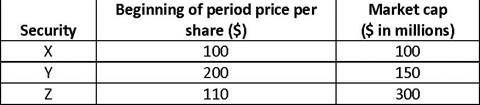

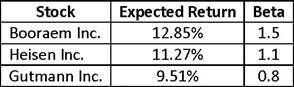

A market index contains the following two securities:

The total return on an equal-weighted basis is closest to:

-

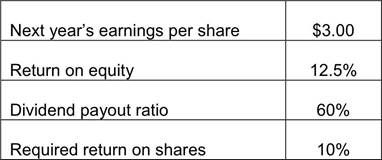

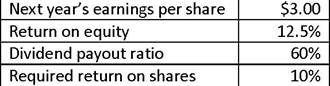

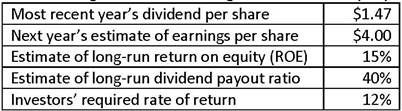

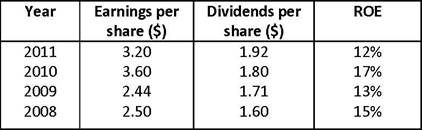

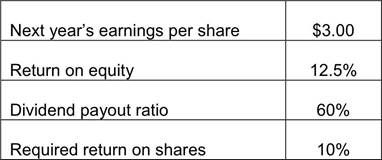

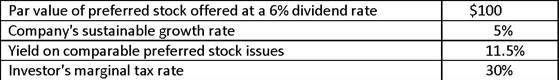

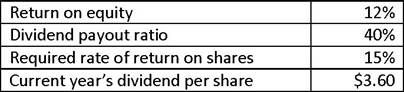

An investor gathers the following data to estimate the intrinsic value of a company's stock using the justified forward price-to-earnings ratio (P/E) approach.

The intrinsic value per share is closest to:

-

Which of the following is most likely a limitation of the yield to maturity measure?

-

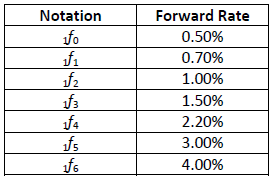

Assume the following annual forward rates were calculated from the yield curve.

The four-year spot rate is closest to:

-

Centro Corp. recently issued a floating-rate note (FRN) that includes a feature that prevents its coupon rate from falling below a prespecified minimum rate. This feature in an FRN is most likely referred to as a:

-

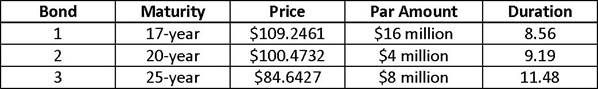

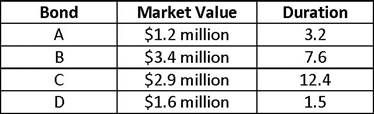

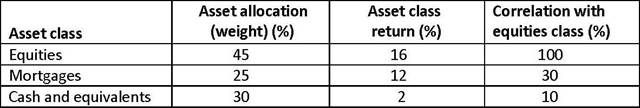

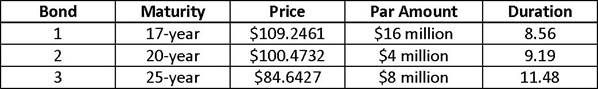

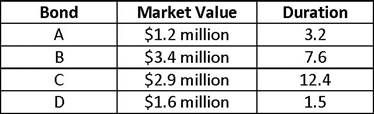

A portfolio manager holds the following three bonds, which are option free and have the indicated durations.

The portfolio's duration is closest to:

-

For bonds that are otherwise identical, the one exhibiting the highest level of positive convexity is most likely the one that is:

-

A BBB rated corporation wishes to issue debt to finance its operations at the lowest cost possible. If it decides to sell a pool of receivables into a special purpose vehicle (SPV), its primary motivation is most likely to:

-

The following table provides information about a portfolio of three bonds.

Based on this information, the duration of the portfolio is closest to:

-

Holding all other characteristics the same, the bond exposed to the greatest level of reinvestment risk is most likely the one selling at:

-

What type of risk most likely affects an investor's ability to buy and sell bonds in the desired amounts and at the desired time?

-

A bond is currently trading for $109.246 per $100 of par value. If the bond's yield to maturity falls by 25 bps, the bond's full price is expected to rise to $110.481. If the bond's yield to maturity rises by 25 bps, the bond's full price is expected to fall to $108.029. The bond's approximate convexity is closest to:

-

Using the following US Treasury forward rates, the value of 2?-year $100 par value Treasury bond with a 5% coupon rate is closest to:

-

Which of the following is least likely a component of the "Four Cs of Credit Analysis" framework?

-

Consider a $100 par value bond with a 7% coupon paid annually and 5 years to maturity. At a discount rate of 6.5%, the value of the bond today is $102.08. One day later, the discount rate increases to 7.5%. Assuming the discount rate remains at 7.5% over the remaining life of the bond, what is most likely to occur to the price of the bond between today and maturity?

-

Using the following US Treasury spot rates, the arbitrage-free value of a two-year $100 par value Treasury bond with a 6% coupon rate is closest to:

-

Which of the following is least likely a part of the execution step of the portfolio management process?

-

If Investor A has a lower risk aversion coefficient than Investor B, will Investor B's optimal portfolio most likely have a higher expected return on the capital allocation line?

-

A portfolio contains equal weights of two securities having the same standard deviation. If the correlation between the returns of the two securities was to decrease, the portfolio risk would most likely:

-

In general, which of the following institutions will most likely have a high need for liquidity and a short investment time horizon?

-

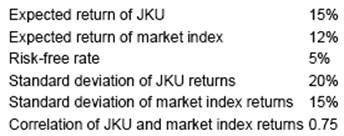

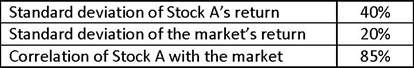

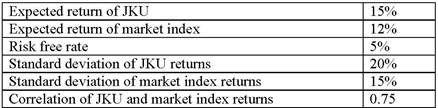

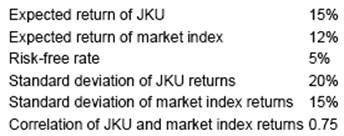

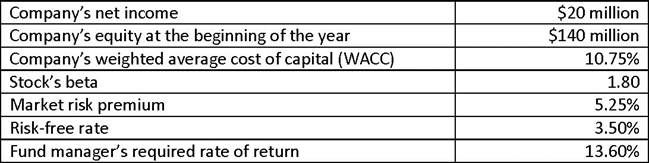

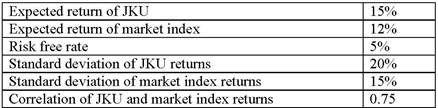

The following table shows data for the stock of JKU and a market index.

Based on the capital asset pricing model (CAPM), JKU is most likely:

-

Carlos Cruz, CFA, is one of two founders of an equity hedge fund. Cruz manages the fund's assets, and the other co-founder, Brian Burkeman, CFA, is responsible for fund sales and marketing. Cruz notices the most recent sales material used by Burkeman indicates assets under management are listed at a higher value than the current market value. Burkeman justifies the discrepancy by stating recent market declines account for the difference. In order to comply with the CFA Institute Standards of Professional Conduct, Cruz should least likely take which of the following actions?

-

Linda Chin, CFA, is a member of a political group advocating less governmental regulation in all aspects of life. She works in a country where local securities laws are minimal and insider trading is not prohibited. Chin's politics are reflected in her investment strategy, where she follows her country's mandatory legal and regulatory requirements. Which of the following actions by Chin is most consistent with the CFA Institute Standards of Professional Conduct?

-

Wouter Duyck, CFA, is the sole proprietor of an investment advisory firm serving several hundred middle-class retail clients. Duyck claims to be different from his competitors because he conducts research himself. He discloses that to simplify the management of all these accounts, he has created a recommended list of stocks, from which he selects investments for all of his clients based on their suitability. Duyck's recommended list of stocks is obtained from his primary broker, who has completed due diligence on each stock. Duyck's recommended list least likely violates which of the following CFA Institute Standards of Professional Conduct?

-

Lisa Hajak, CFA, specialized in research on real estate companies at Cornerstone Country Bank for 20 years. Hajak recently started her own investment research firm, Hajak Investment Advisory. One of her former clients at Cornerstone asks Hajak to update a research report she wrote on a real estate company when she was at Cornerstone. Hajak updates the report, which she had copied to her personal computer without the bank's knowledge, and replaces references to the bank with her new firm, Hajak Investment Advisory. Hajak also incorporates the conclusions of a real estate study conducted by the Realtors Association that appeared in the Wall Street Journal. She cites the Journal as her source in her report. She provides the revised report free of charge along with a cover letter for the bank's client to become a client of her firm. Concerning the reissued research report, Hajak least likely violated the CFA Institute Standards of Professional Conduct because she:

-

Tonya Tucker, CFA, is a financial analyst at Bowron Consolidated. Bowron has numerous subsidiaries and is actively involved in mergers and acquisitions to expand its businesses. Tucker analyzes a number of companies, including Hanchin Corporation. When Tucker speaks with the CEO of Bowron, she indicates many of the companies she has looked at would be attractive acquisition targets for Bowron. After her discussion with the CEO, Tucker purchases 100,000 shares of Hanchin Corporation at $200 per share. Bowron does not have any pre-clearance procedures, so the next time she meets with the CEO, Tucker mentions she owns shares of Hanchin. The CEO thanks her for this information but does not ask for any details. Two weeks later, Tucker sees a company-wide email from the CEO announcing Bowron's acquisition of Hanchin for $250 a share. In regard to her purchase of Hanchin stock, Tucker leastlikelyviolated the CFA Institute Standards of Professional Conduct concerning:

-

When a client asks her how she makes investment decisions, Petra Vogler, CFA, tells the client she uses mosaic theory. According to Vogler, the theory involves analyzing public and nonmaterial nonpublic information, including the evaluation of statements made to her by company insiders in one-on-one meetings where management discusses new earnings projections not known to the public. Vogler also gathers general industry information from industry experts she has contacted. Vogler most likelyviolates the CFA Institute Standards of Professional Conduct because of her use of:

-

Lin Liang, CFA, is an investment manager and an auto industry expert. Last month, Liang sent securities regulators an anonymous letter outlining various accounting irregularities at Road Rubber Company. Shortly before he sent the letter to the regulators, Liang shorted Road stock for his clients. Once the regulators opened an investigation, which Liang learned about from his sources inside the company, Liang leaked this information to multiple sources in the media.

When news of the investigation became public, the share price of Road immediately dropped30%. Liang then covered the short positions and made $5 per share for his clients. Liang least likelyviolated which of the CFA Institute Standards of Professional Conduct?

-

Sanjay Gupta, CFA, is interviewed by the First Faithful Church to manage the church's voluntary retirement plan's equity portfolio based upon his superior return history. Each church staff member chooses whether to opt in or out of the retirement plan according to his or her own investment objectives. The plan trustees tell Gupta that stocks of companies involved in the sale of alcohol, tobacco, gambling, or firearms are not acceptable investments given the objectives and constraints of the portfolio. Gupta tells the trustees he cannot reasonably execute his strategy with these restrictions and that all his other accounts hold shares of companies involved in these businesses because he believes they have the highest alpha. By agreeing to manage the account according to the Trustees' wishes, does Gupta violate the CFA Institute Standards of Professional Conduct?

-

Jorge Lopez, CFA, is responsible for proxy voting on behalf of his bank's asset management clients. Lopez recently performed a cost-benefit analysis, showing that proxy-voting analysis might not benefit the bank's clients. As a result, Lopez immediately changes the proxy-voting policies and procedures without informing anyone else of the change. Lopez now votes client proxies on the side of management on all issues with the exception of major mergers where a significant impact on the stock price is expected. Lopez least likely violated the CFA Institute Standards of Professional in regard to:

-

Tamlorn Mager, CFA, is an analyst at Pyallup Portfolio Management. CFA Institute recently notified Mager that his CFA Institute membership was suspended for a year because he violated the CFA Code of Ethics. A hearing panel also came to the same conclusion. Mager subsequently notified CFA Institute he does not accept the sanction, or the hearing panel's conclusion. Which of the following actions by Mager is most consistent with the CFA Institute Professional Conduct Program?

-

Edo Ronde, CFA, an analyst for a hedge fund, One World Investments, is attending a key industry conference for the microelectronics industry. At lunch in a restaurant adjacent to the conference venue, Ronde sits next to a table of conference attendees and is able to read their nametags. Ronde realizes the group includes the president of a publicly traded company in the microelectronics industry, Fulda Manufacturing, a company Ronde follows. Ronde overhears the president complain about a production delay problem Fulda's factories are experiencing. The president mentions the delay will reduce Fulda earnings more than 20% during the next year if not solved. Ronde relays this information to the portfolio manager he reports to at One World explaining that in a recent research report he recommended Fulda as a buy. The manager asks Ronde to write up a negative report on Fulda so the fund can sell the stock. According to the CFA Institute Code of Ethics and Standards of Professional Conduct, Ronde should least likely:

-

Jennifer Ducumon, CFA, is a portfolio manager for high-net-worth individuals at Northeast Investment Bank. Northeast holds a large number of shares in Baby Skin Care Inc., a manufacturer of baby care products. Northeast obtained the Baby Skin Care shares when it underwrote the company's recent IPO. Ducumon has been asked by the investment-banking department to recommend Baby Skin Care to her clients, who currently do not hold any shares in their portfolios. Although Ducumon has a favorable opinion of Baby Skin Care, she does not consider the shares a buy at the IPO price nor at current price levels. According to the CFA Institute Code of Ethics and Standards of Professional Conduct, the most appropriate action for Ducumon is to:

-

Heidi Halvorson, CFA, is the chief investment officer for Tukwila Investors, an asset management firm specializing in fixed-income investments. Tukwila is in danger of losing one of its largest clients, Quinault Jewelers, which accounts for nearly one-third of its revenues. Quinault recently told Halverson that Tukwila would be fired unless the performance of Quinault's portfolio improves significantly. Shortly after this conversation, Halvorson purchases two corporate bonds she believes are suitable for any of her clients based upon third-party research from a reliable and diligent source. Immediately after the purchase, one bond increases significantly in price while the other bond declines significantly. At the end of the day, Halvorson allocates the profitable bond trade to Quinault and the other bond to two of her largest institutional accounts. Halvorson most likely violated the CFA Institute Standards of Professional in regard to:

-

Randolf is single and willing to invest a portion of his assets very aggressively; Kitagawa wants to achieve a steady rate of return with low volatility so she can pay for her child's current college expenses. Amadon recommends investing 20% of both clients' portfolios in the stock of very low yielding small-cap companies. Amadon least likely violated the CFA Institute Code of Ethics and Standards of Professional Conduct in regard to his investment recommendations for:

-

Thomas Turkman recently hired Georgia Viggen, CFA, as a portfolio manager for North South Bank. Although Viggen worked many years for a competitor, West Star Bank, the move was straightforward because she did not have a non-compete agreement with her previous employer. Once Viggen starts working for Turkman, the first thing she does is to bring a trading software package she developed and used at West Star to her new employer. Using public information, Viggen contacts all of her former clients to convince them to move with her to North South. Viggen also convinces one of the analysts she worked with at West Star to join her at her new employer. Viggen most likelyviolated the CFA Institute Code of Ethics and Standards of Professional Conduct concerning her actions involving:

-

Suni Kioshi, CFA, is an analyst at Pacific Asset Management, where she covers small-capitalization companies. On her own time, Kioshi often speculates in low-price thinly traded stocks for her own account. Over the last three months, Kioshi has purchased 50,000 shares of Basic Biofuels Company, giving her a 5% ownership stake. A week after this purchase, Kioshi is asked to write a report on stocks in the biofuels industry, with a request to complete the report within two days. Kioshi wants to rate Basic as a "buy" in this report but is uncertain how to proceed. Concerning the research report, what action should Kioshi most likely take to prevent violating any of the CFA Institute Code of Ethics and Standards of Professional Conduct?

-

Solomon Sulzberg, CFA, is a research analyst at Blue Water Management. Sulzberg's recommendations typically go through a number of internal reviews before they are published. In developing his recommendations, Sulzberg uses a model developed by a quantitative analyst within the firm. Sulzberg made some minor changes to the model but retained the primary framework. In his reports, Sulzberg attributes the model to both the quantitative analyst and himself. Before the internal reviews of his reports are completed, Sulzberg buys shares in one of the companies. After the internal review is complete, he fails to recommend the purchase of the stock to his clients and erases all of his research related to this company. Sulzberg least likely violated the CFA Institute Code of Ethics and Standards of Professional Conduct related to:

-

Chris Rodriguez, CFA, is a portfolio manager at Nisqually Asset Management, which specializes in trading highly illiquid shares. Rodriguez has been using Hon Securities Brokers almost exclusively when making transactions for Nisqually clients, as well as for his own relatively small account.

Hon always executes Rodriguez's personal trades at a more preferential price than for Rodriguez's clients' accounts. This occurs regardless of whether or not Rodriguez personally trades before or after clients. Rodriguez should least likely do which of the following in order to comply with the CFA Institute Code of Ethics and Standards of Professional Conduct?

-

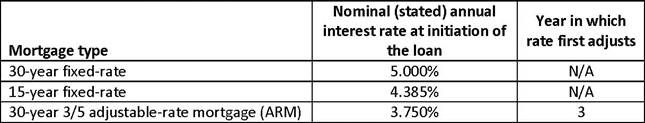

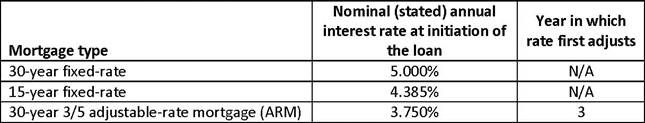

A borrower is considering three competing mortgage loan offers from her bank, The amount borrowed on the mortgage is $100,000 with monthlv compounding,

The rate on the ARM resets at the end of Year 3. Assuming the ARM is reset at 5.500% (i.e., the remaining balance on the loan will now be repaid with 5.500% nominal annual interest), which of the three loans will have the smallest monthly payment after the rate reset at the end of Year 3?

-

A U.S. Treasury bill (T-bill) has 90 days to maturity and a bank discount yield of 3.25%. The effective annual yield (EAY) for the T-bill is closest to:

-

By definition, the probability of any event, E, is a number between:

-

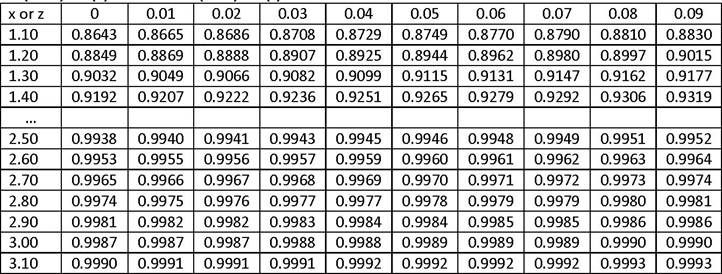

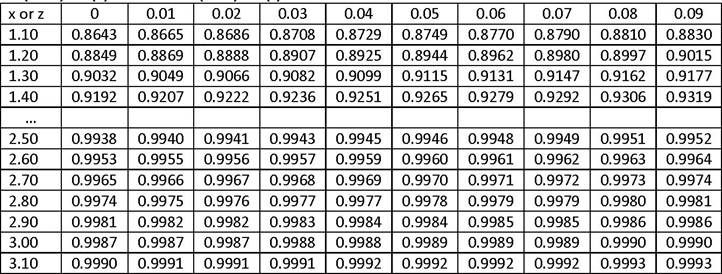

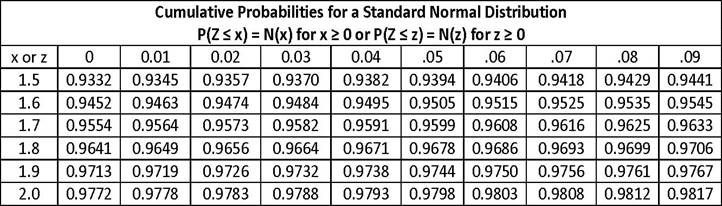

A variable is normally distributed with a mean of 5.00 and a variance of 4.00. Calculate the probability of observing a value of negative 0.40 or less. That is, calculate P (Xi ≤ -0.40) given X is distributed as N(5,4). Use this excerpt from the cumulative distribution function for the standard normal random variable table to calculate your answer.

Cumulative Probabilities for a Standard Normal Distribution

P(Z ≤x) = N(x) for x ≥ 0 or P(Z ≤ z) = N(z) for z ≥ 0

The calculated value is closest to:

-

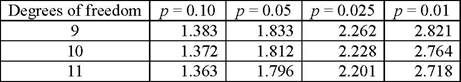

In setting the confidence interval for the population mean of a normal or approximately normal distribution and given that the sample size is small, Student's t-distribution is the preferred approach when the variance is:

-

A two-tailed test of the null hypothesis that the mean of a distribution is equal to 4.00 has a p-value of 0.0567. Using a 5% level of significance (i.e., α = 0.05), the best conclusion is to:

-

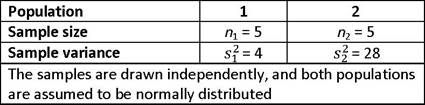

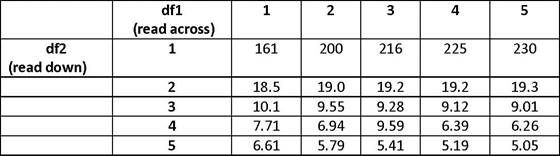

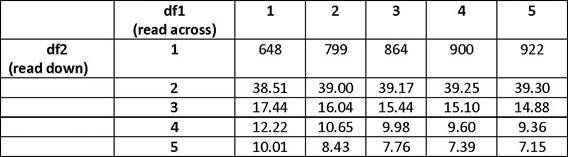

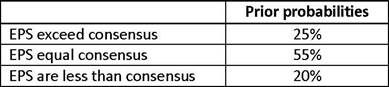

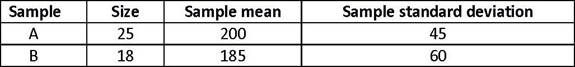

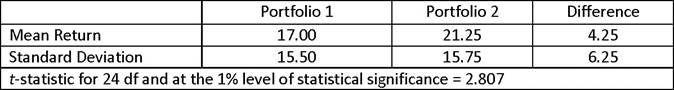

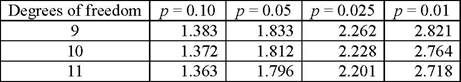

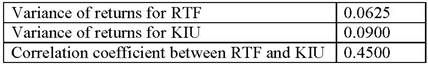

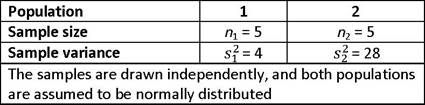

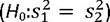

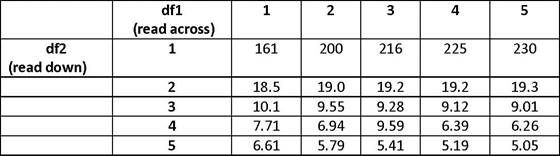

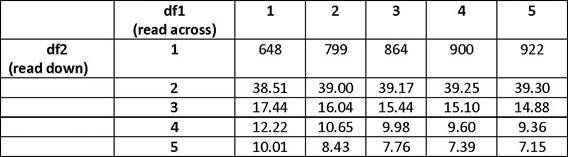

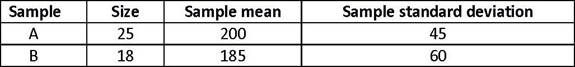

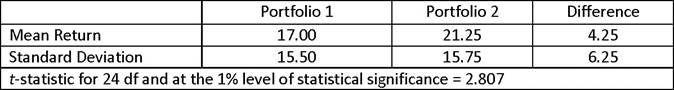

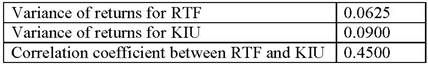

Using the above data, an analyst is trying to test the null hypothesis that the population variances are equal  against the alternative hypothesis that the variances are not equal

against the alternative hypothesis that the variances are not equal  at the 5% level of significance. The table of the F-Distribution is provided below.

at the 5% level of significance. The table of the F-Distribution is provided below.

Table of the F-Distribution

Panel A: Critical values for right-hand tail areas equal to 0.05

Panel B: Critical values for right-hand tail areas equal to 0.025

Which of the following statements is most appropriate? The critical value is:

-

In Elliott Wave Theory, Wave 2 commonly exhibits a pattern best described as a(n):

-

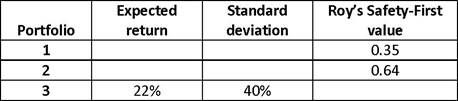

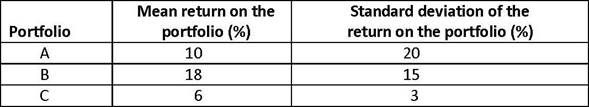

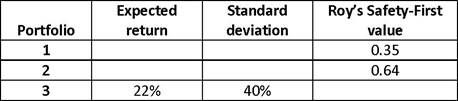

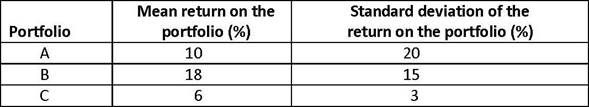

An investor wants to maximize the possibility of earning at least 5% on her investments each year. Using Roy's safety-first criterion, which of the following portfolios is the most appropriate choice?

-

Which of the following is the least likely characteristic of the normal probability distribution. The normal probability distribution:

-

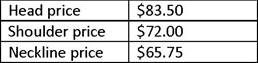

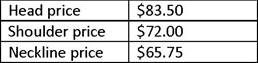

A technical analyst observes a head and shoulders pattern in a stock she has been following. She notes the following information:

Based on this information, her estimate of the price target is closest to:

-

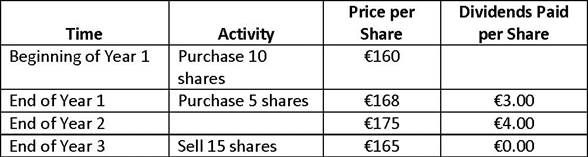

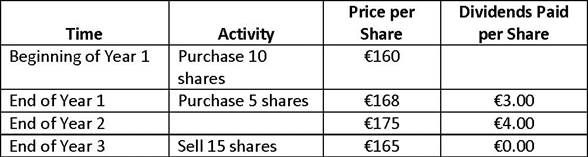

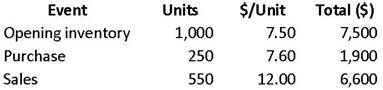

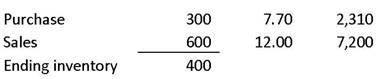

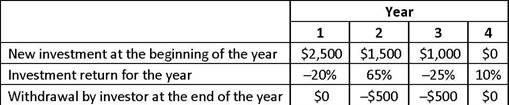

The following table represents the history of an investment in a company:

The investor does not reinvest the dividends that he receives. Assuming no taxes on dividends, the time-weighted rate of return on this investment is closest to:

-

Which of the following most accurately describes a distribution that is more peaked than normal?

-

A fund manager would like to estimate the probability of a daily loss higher than 5% on the fund he manages. He decides to employ a method that uses the relative frequency of occurrence based on historical data. The resulting probability is best known as:

-

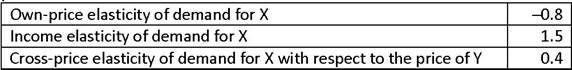

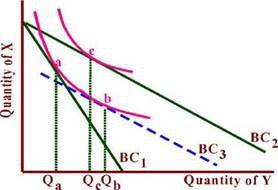

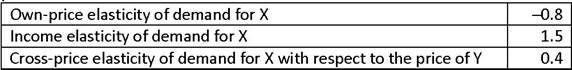

The market demand function for item X is a function of its price, household income, and the price of item Y.

Given the above elasticity coefficients for the two items, which of the following statements is most accurate?

-

The monthly demand curve for playing tennis at a particular club is given by the following equation: PTennis Match = 9 - 0.20 × QTennis Matrix. The club currently charges members $4.00 to play a match but is considering changing to a new flat-rate monthly membership fee for unlimited play. The most that the club will be able to charge for the flat-rate monthly membership is closest to:

-

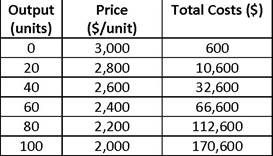

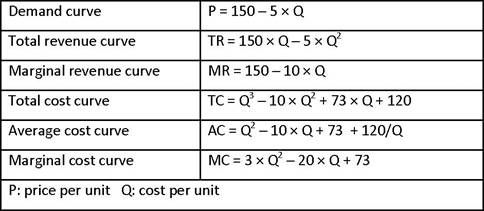

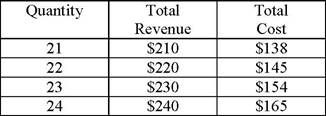

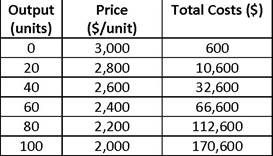

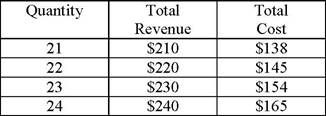

With its existing production facilities, a monopolist firm can produce up to 100 units. It faces the following demand and cost schedules:

The optimal output level for this producer (in units) is closest to:

-

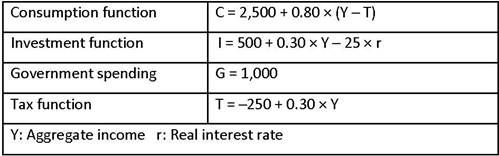

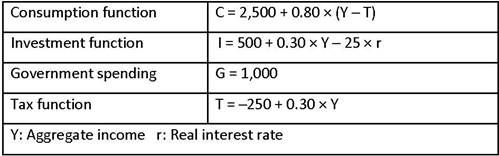

The following information applies to an economy:

The unemployment rate in the economy is closest to:

-

In an economy, consumption is 70% of pre-tax income and the average tax rate is 25% of total income. If planned government expenditures are expected to increase by S1.25 billion, the increase in total incomes and spending ($ in billions) is closest to:

-

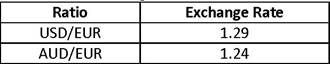

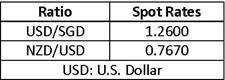

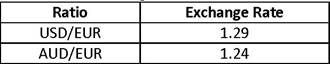

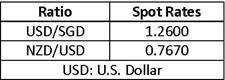

An Australian firm purchased a patent for USD20,000 and machinery for USD21,500 from a U.S. firm when the exchange rates were as follows:

The impact of these transactions on the capital account of Australia (in AUD) is closest to:

-

Which of the following statements with respect to Giffen and Veblen goods is least accurate?

-

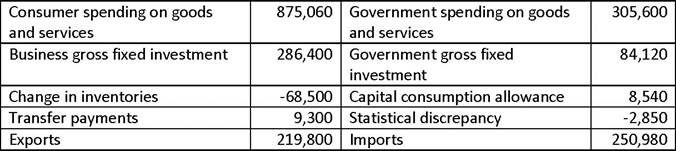

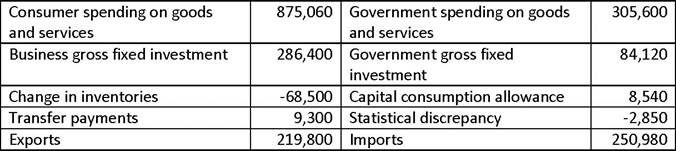

The following data apply to a country in its domestic currency units:

Using the expenditures approach, the country's gross domestic product (GDP) is closest to:

-

As a monetary policy tool, quantitative easing (QE) will most likely help revive an ailing economy in which of the following environments?

-

A firm in the market environment characterized by monopolistic competition will most likely:

-

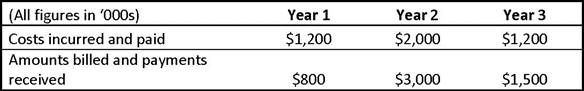

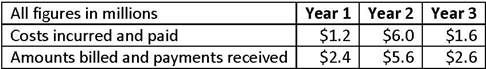

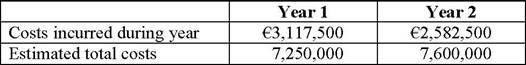

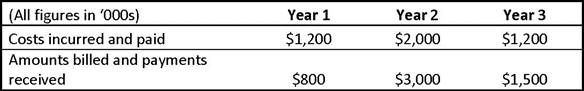

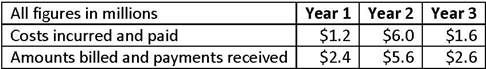

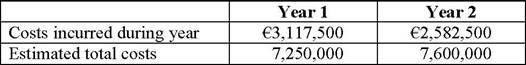

A company entered into a three-year construction project with a total contract price (all figures in '000s) of $5,300 and expected costs of $4,400. The company recognizes revenue using the percentage of completion method. The data below relate to the contract.

The amount of revenue (in $'O00s) the company will recognize in Year 2 is closest to:

-

In the audit report, an additional paragraph that explains an exception to an accounting standard is best described as a(n):

-

Which of the following is least likely a characteristic of an effective financial reporting framework?

-

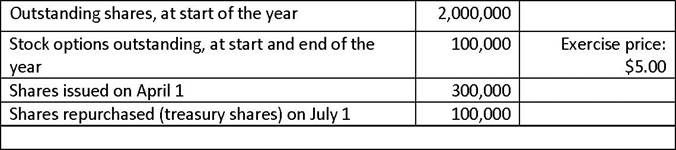

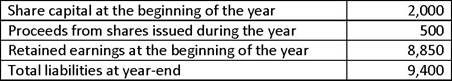

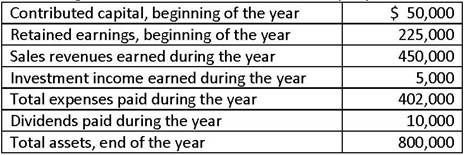

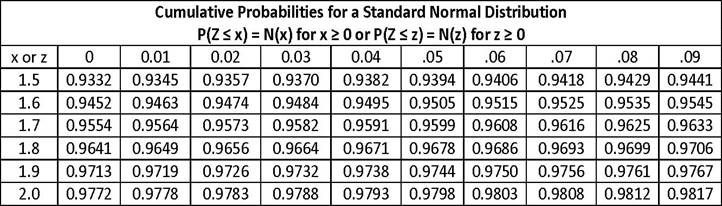

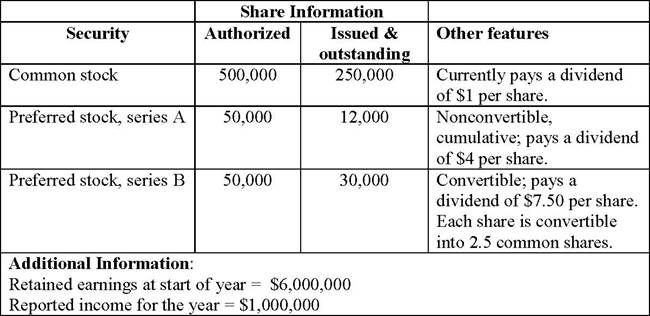

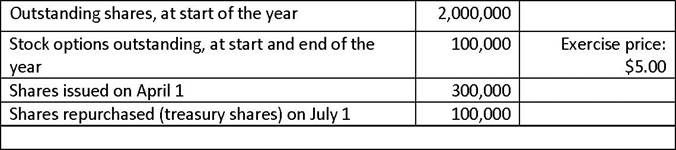

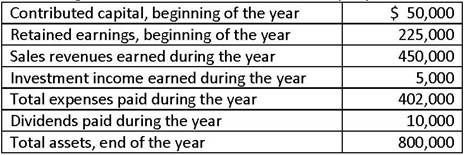

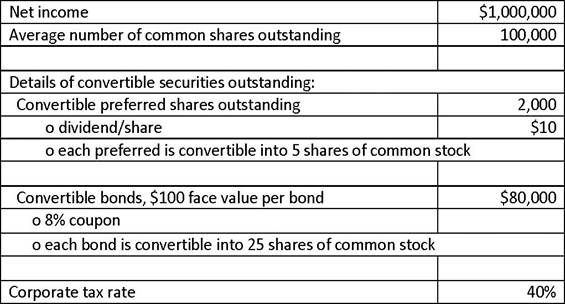

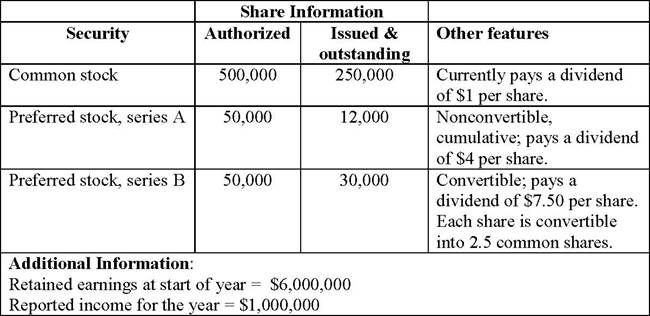

The following relates to a company's common ecluity over the course of the year:

If the company's net income for the year is $5,000,000, its diluted EPS is closest to:

-

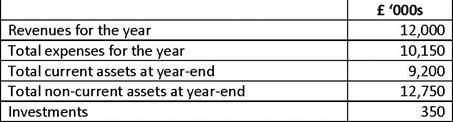

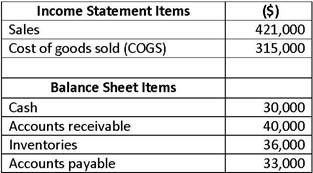

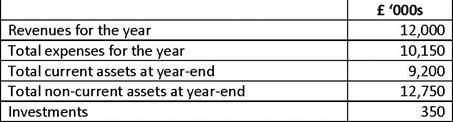

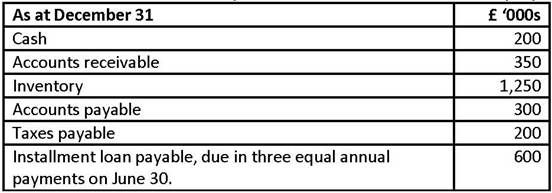

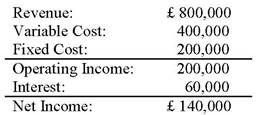

An analyst has compiled the following information on a company:

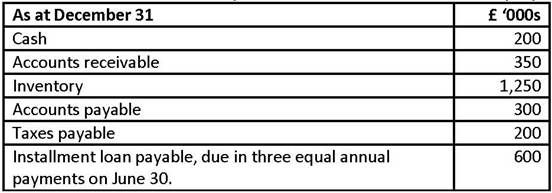

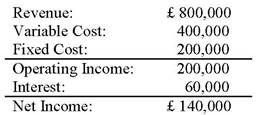

The amount of dividends declared (£ '000s) during the year is closest to:

-

A cell phone manufacturer has switched to high margin premium-priced products with the most innovative features as part of its product differentiation strategy. Which of the following other changes is most consistent with this strategy?

-

Which of the following is the most likely reason for an analyst to choose the direct method rather than the indirect method for analyzing a firm's operating cash flows?

-

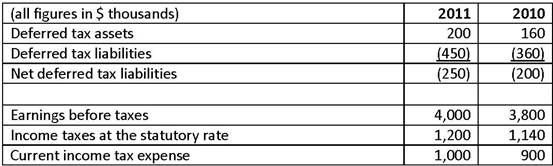

In the current year, a company increased its deferred tax asset by $500,000. During the year, the company most likely:

-

A country implements policies that are expected to increase taxes by €100 million, increase government spending by €50 million, and reduce investments and private sector savings by €25 million each. As a result, the country's current account balance will most likely:

-

In early 2011, the British pound (GBP) to New Zealand dollar (NZD) spot exchange rate was 2.0979. LIBOR interest rates, quoted on a 360-day year basis, were 1.6025% for the British pound and 3.2875% for the New Zealand dollar. The 180-day forward points (scaled up by four decimal places) in G BP/NZD would be closest to:

-

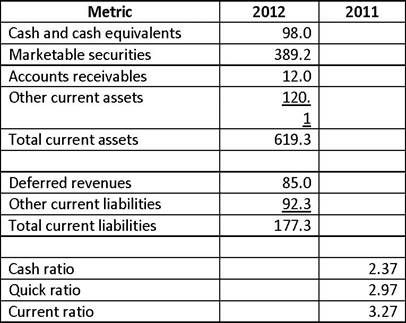

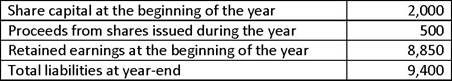

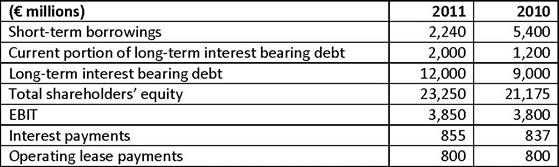

The following selected balance sheet and ratio data are available for a company:

Which of the following ratios decreased between 2011 and 2012?

-

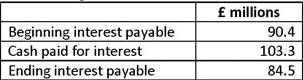

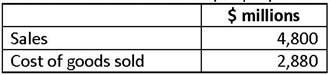

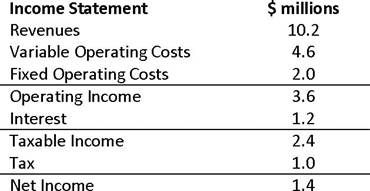

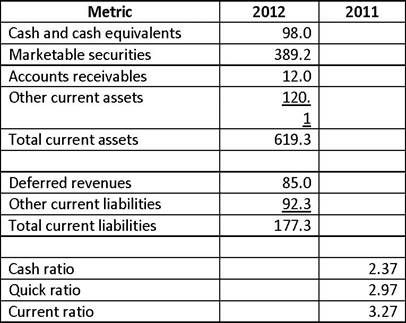

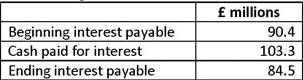

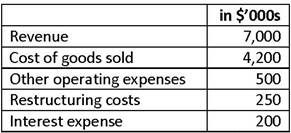

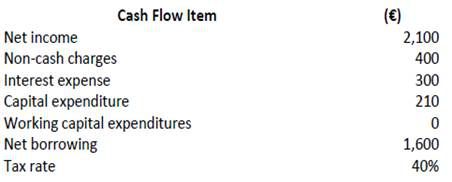

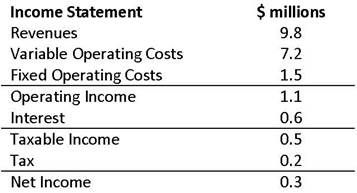

The following annual financial data are available for a company:

Interest expense for the year is closest to:

-

Financial ratios alone are least likely helpful to determine a company's:

-

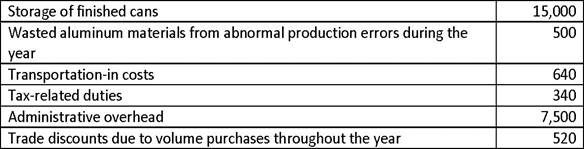

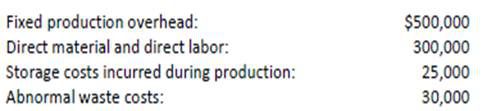

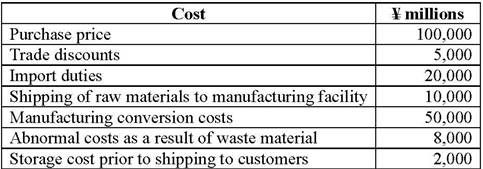

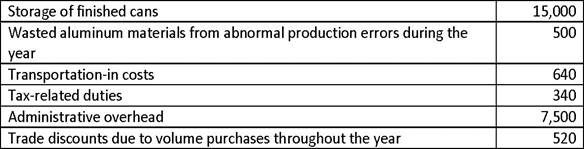

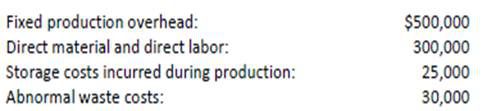

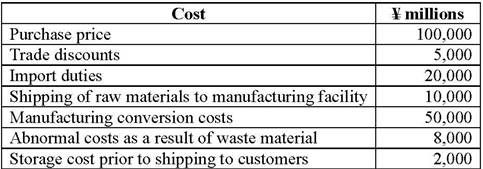

A company manufactures aluminum cans for the beverage industry and prepares its financial statements in accordance with IFRS. During its latest full fiscal year, the company recorded the following data:

The total costs included in inventory (in €) for the year are closest to:

-

An accounting document that records transactions in the order in which they occur is best described as a:

-

Which of the following statements is most accurate with respect to financial reporting requirements?

-

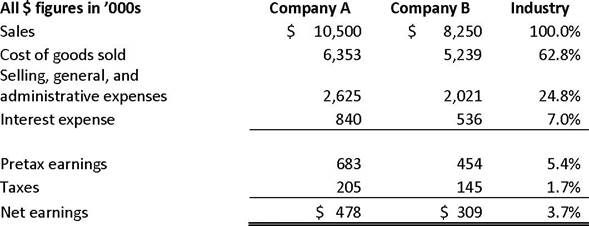

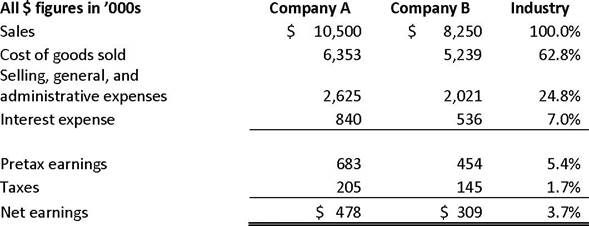

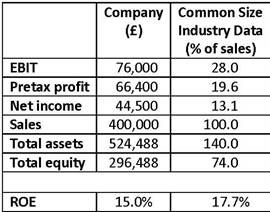

Income statements for two companies (A and B) and the common-sized income statement for the industry are provided below:

The best conclusion an analyst can make is that:

-

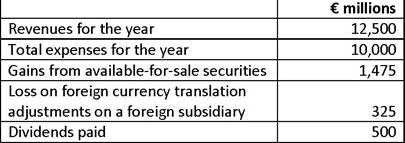

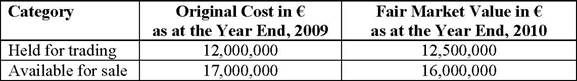

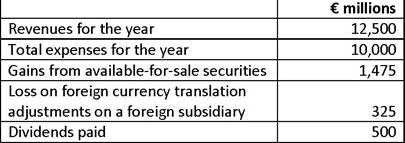

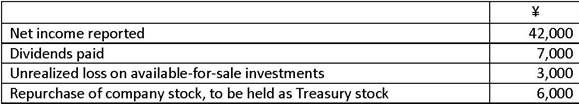

The following information is from a company's accounting records:

The company's total comprehensive income (in € millions) is closest to:

-

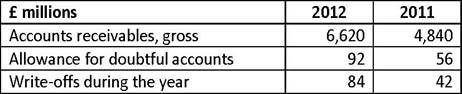

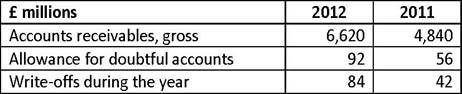

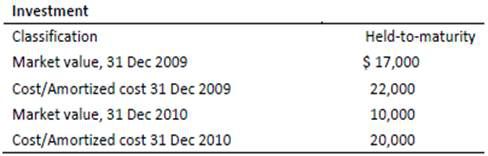

Based on the above information about a company's trade receivables, the bad debt expense (in millions) for 2012 is closest to:

-

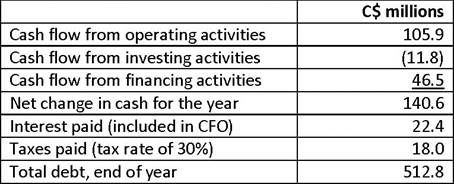

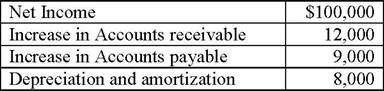

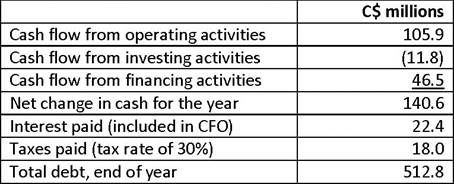

An analyst has gathered the following information about a company:

The cash flow debt coverage ratio for the year is closest to:

-

Which inventory method best matches the actual historical cost of the inventory sold with their physical flow if a company is using a perpetual inventory system?

-

On 1 January, a company, which prepares its financial statements according to IFRS, arranged financing for the construction of a new plant. The company:

·borrowed NZ$5,000,O00 at an interest rate of 8%,

·issued NZ$5,000,O00 of preferred shares with a cumulative dividend rate of 6%, and

·temporarily invested NZ$2,000,O00 of the loan proceeds for the first six months of construction and earned 7% on that amount.

The amount of financing costs to be capitalized (NZ$) to the cost of the plant in the first year is closest to:

-

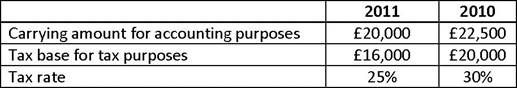

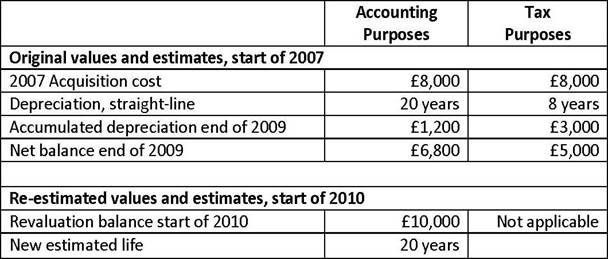

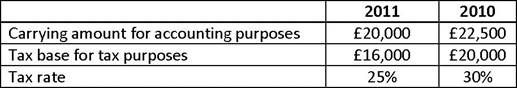

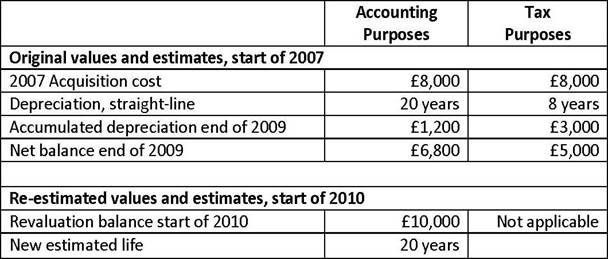

A company purchased equipment in 2010 for £25,000. The year-end values of the equipment for accounting purposes and tax purposes are as follows:

Which of the following statements best describes the effect of the change in the tax rate on the company's 2011 financial statements? The deferred tax liability:

-

A company took the following actions related to $5 million of lO-year bonds with a coupon rate of 8% payable semi-annually on 30 June and 31 December:

-

On a cash flow statement prepared using the indirect method, which of the following would most likely increase the cash from investing activities?

-

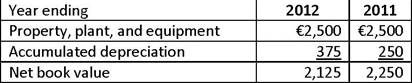

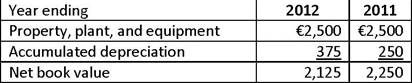

An analyst has gathered the followin information about a company's capital assets:

As of the end of 2012, the expected remaining life of the assets, in years, is closest to:

-

Given the following information about a firm:

·debt-to-equity ratio of 50%

·tax rate of 40%

·cost of debt of 8%

·cost of equity of 13%,

the firm's weighted average cost of capital (WACC) is closest to:

-

The unit contribution margin for a product is $20. A firm's fixed costs of production of up to 300,000 units is $500,000. The degree of operating leverage (DOL) is most likely the lowest at which of the following production levels (in units)?

-

Which of the following share repurchase methods will most likely take the longest amount of time to execute?

-

Assume a 365-day year and the following information for a company:

The firm's days in payables for the current year is closest to:

-

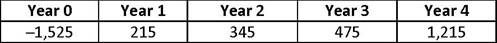

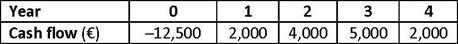

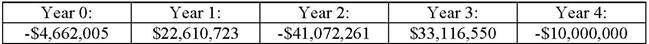

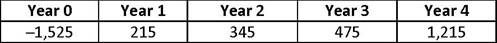

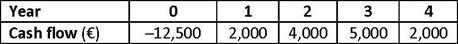

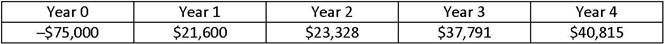

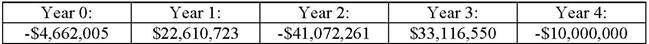

A project has the following cash flows (£):

Assuming a discount rate of 11% annually, the discounted payback period (in years) is closest to:

-

Based on best practices in corporate governance procedures, it is most appropriate for a company's compensation committee to:

-

Which action is most likely considered a secondary source of liquidity?

-

A company has a fixed $1,100 capital budget and has the opportunity to invest in the four independent projects below.

The combination of projects that provides the best choice is:

-

Which of the following statements is the most appropriate treatment of floatation costs for capital budgeting purposes? Floatation costs should be:

-

A firm is uncertain about both the number of units the market will demand and the price it will receive for them. This type of risk is best described as:

-

Which of the following statements is most accurate?

-

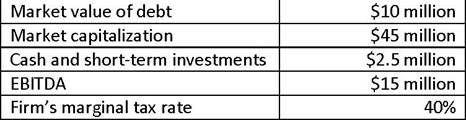

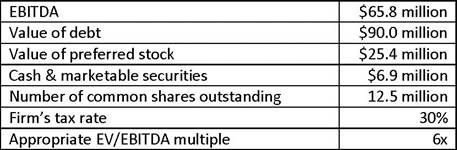

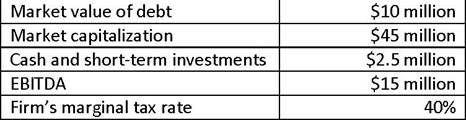

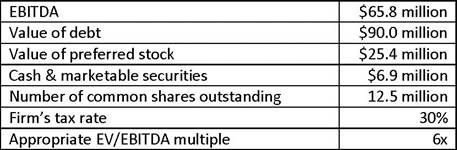

An investor who wants to estimate the enterprise value multiple (EV/EBITDA) of a company has gathered the following data:

The company's EV/EBITDA multiple is closest to:

-

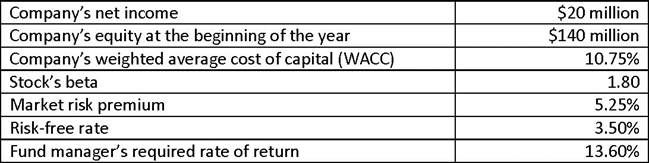

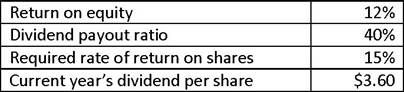

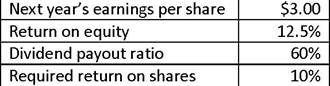

An investor gathers the following data to estimate the intrinsic value of a company's stock using the justified forward P/E approach.

The intrinsic value per share is closest to:

-

A company's series B,8% preferred stock has the following features:

·A par value of $50 and pays quarterly dividends.

·Its current market value is $35.

·The shares are retractable (at par) with the retraction date set for three years from today.

·Similarly rated preferred issues have an estimated nominal required rate of return of 12%.

·Analysts expect a sustainable growth rate of 4% for the company's earnings.

The intrinsic value estimate of a share of this preferred issue is closest to:

-

Which of the following inferences concerning market efficiency is most accurate?

-

Which of the following multiples is most useful when comparing companies with significant differences in capital structure?

-

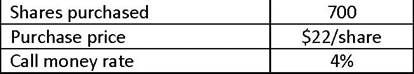

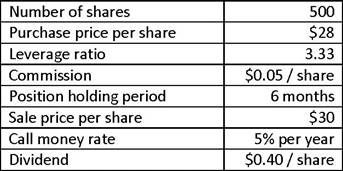

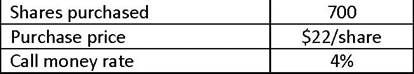

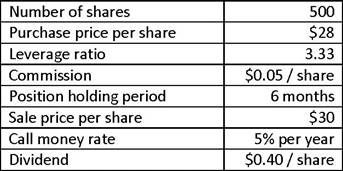

An investor buys stock on margin and holds the position for exactly one year.

Assuming that the interest on the loan and the dividend are both paid at the end of the year, the price at which the investor sold the stock is closest to:

-

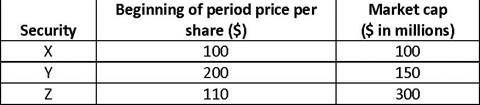

A market index only contains the following three securities:

Which approach to indexing will most likely give Security X a weight of 18%?

-

Which of the following is most accurate concerning key characteristics of different types of preference shares?

-

An equity portfolio manager is evaluating her sector allocation strategy for the upcoming year. She expects global economic slowdown for the next two years. Further, she believes that companies will be facing diminishing growth rates with respect to revenues and profits. Owing to these beliefs, the portfolio manager will most likely:

-

A company has issued non-callable, non-convertible preferred stock with the following features:

·Par value per share $10

·Annual dividend per share $2

·Maturity 15 years

If an investor's required rate of return is 8% and the current market price per share of the preferred stock is $25, the most likely conclusion is that the preferred stock is:

-

Which of the following statements is least accurate? A firm's free-cash-flow-to-equity (FCFE):

-

Which of the following statements best describes an advantage of a forward contract over a futures contract? A forward contract:

-

A forward rate agreement (FRA) that expires in 180 days and is based on 90-day LIBOR is quoted at 2.2%. At expiration of the FRA,90-day LIBOR is 2.8%. For a notional principal of USDI,000,000, the payoff of this FRA is closest to:

-

Consider a U.S. Treasury bond futures contract where the hypothetical deliverable bond has a coupon of 3.0%. At expiration of the futures contract, the short chooses to deliver a bond with a coupon of 3.8%. The conversion factor of this bond is most likely:

-

An investor purchases a put option on AAA shares that has a strike price of €50 and expires in three months. One month later, AAA shares are trading at €54. At that time, the put most likely has:

-

The tenor of a swap is best described as the:

-

An investor purchases 100 shares of common stock at €50 each and simultaneously sells call options on 100 shares of the stock with a strike price of €55 at a premium of €1 per option. At the expiration date of the options, the share price is €58. The investor's profit is closest to:

-

An investor purchases the bonds of JLD Corp., which pay an annual coupon of 10% and mature in 10 years, at an annual yield to maturity of 12%. The bonds will most likely be selling at:

-

A portfolio manager holds the following three bonds, which are option free and have the indicated durations.

The portfolio's duration is closest to:

The portfolio's duration is closest to:

-

For a collateralized mortgage obligation (CMO), the first tranche of bonds most likely has the:

-

A bond with a par value of $100 matures in 10 years with a coupon of 4.5%, paid semiannually; is priced to yield 5.83%; and has a modified duration of 7.81. If the yield of the bond declines by 0.25%, the approximate percentage price change for the bond is closest to:

-

When are credit spreads most likely to narrow? During:

-

If the yield to maturity on an annual-pay bond is 7.75%, the bond-equivalent yield is closest to:

-

The duration and convexity of an option-free bond priced at $90.25 are 10.34 and 75.80, respectively. If yields increase by 200 basis points, the percentage change of the price is closest to:

-

Which of the following is most likely a limitation of the yield-to-maturity measure?

-

Which of the following, rnost likely exhibits negative convexity?

-

An investor is least likely exposed to reinvestment risk from owning, a(n):

-

All other things being equal, a decrease in expected yield volatility most likely increases the price of:

-

Which of the following is least likely an interest rate policy tool available to the U.S. Federal Reserve?

-

U.S. farmers have become concerned that the future supply of wheat production will exceed demand. Any hedging activity to sell forward would most likely protect against which market condition?

-

Relative to traditional investments.alternative investments are best characterized as having:

-

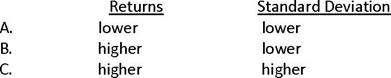

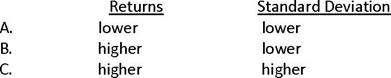

Adding alternative investments to a portfolio of traditional investments will most likely result in a new combined portfolio with returns and standard deviation that are, respectively:

-

For a hedge fund investor, a benefit of investing in a fund of funds is least likely the:

-

Which attributes would a private equity firm most likely consider when deciding if a company is particularly attractive as a leveraged buyout target?

-

High-water marks are typically used when calculating the incentive fee on hedge funds. They are most likely used by clients to:

-

Which of the following is least likely a part of the execution step of the portfolio management process?

-

The correlation between the historical returns of Stock A and Stock B is 0.75. If the variance of Stock A is 0.16 and the variance of Stock B is 0.09, the covariance of returns of Stock A and Stock B is closest to:

-

The point of tangency between the capital allocation line (CAL) and the efficient frontier of risky assets most likely identifies the:

-

The stock of G BK Corporation has a beta of 0.65. If the risk-free rate of return is 3% and the expected market return is 9%, the expected return for G BK is closest to:

-

A return-generating model that provides an estimate of the expected return of a security based on factors such as earnings growth and cash flow generation is best described as a:

-

A portfolio manager generated a rate of return of 15.5% on a portfolio with beta of 1.2. If the risk-free rate of return is 2.5% and the market return is 11.8%, Jensen's alpha for the portfolio is closest to:

-

Bailey Watson, CFA manages 25 emerging market pension funds. He recently had the opportunity to buy 100,000 shares in a publicly listed company whose prospects are considered “above industry norm” by most analysts. The company's shares rarely trade because most managers take a “buy and hold” strategy because of the company's small free float. Before placing the order with his dealer, Watson allocated the shares to be purchased according to the weighted value of each of his clients' portfolios. When it came time to execute the trades, the dealer was only able to purchase 50,000 shares. To prevent violating Standard III (B) Fair Dealing, it would be most appropriate for Watson to reallocate the 50,000 shares purchased by:

-

Dilshan Kumar, CFA, is a world-renowned mining analyst based in London. Recently, he received an invitation from Cerberus Mining, a London Stock Exchange listed company with headquarters in Johannesburg, South Africa. Cerberus asked Kumar to join a group of prominent analysts from around the world on a tour of its mines in South Africa, some of which are in remote locations, not easily accessible. The invitation also includes an arranged wildlife safari to Krueger National Park for the analysts. Kumar accepts the invitation, planning to visit other mining companies he covers in Namibia and Botswana after the safari. To prevent violating any CFA Institute Standards of Professional Conduct, it is most appropriate for Kumar to only accept which type of paid travel arrangements from Cerberus?

-

Abdul Naib, CFA, was recently asked by his employer to submit an updated document providing the history of his employment and qualifications. The existing document on file was submitted when he was hired five years ago. His employer notices the updated version shows Naib obtained his Master of Business Administration (MBA) degree two years ago, whereas the earlier version indicated he had already obtained his MBA. Because the position Naib was hired for had a minimum qualification of an MBA, Naib is asked to explain the discrepancy. He justifies his actions by stating: “I knew you wouldn't hire me if I didn't have an MBA degree, but I already had my CFA designation. Knowing you required an MBA, I went back to school on a part-time basis after I was hired to obtain it. I graduated at the top of my class, but this shouldn't come as any surprise, as you have seen evidence I passed all of my CFA exams on the first attempt.” Did Naib most likely violate the CFA Institute Standards of Professional Conduct?

-

Jack Steyn, CFA, recently became the head of the trading desk at a large investment management firm that specializes in domestic equities. While reviewing the firm's trading operations, he notices clients give discretion to the manager to select brokers on the basis of their overall services to the management firm. Despite the client directive, Steyn would most likely violate Standard III (A) Loyalty, Prudence, and Care if he pays soft commissions for which of the following services from the brokers?

-

Elbie Botha, CFA, an equity research analyst at an investment bank, disagrees with her research team's buy recommendation for a particular company's rights issue. She acknowledges the recommendation is based on a well-developed process and extensive research but feels the valuation is overpriced based on her assumptions. Despite her contrarian view, her name is included on the research report to be distributed to all of the investment bank's clients. To avoid violating any CFA Institute standards, it would be least appropriate for Botha to undertake which of the following?

-

Colleen O'Neil, CFA, manages a private investment fund with a balanced global investment mandate. Her clients insist that her personal investment portfolio replicate the investments within their portfolio to assure them she is willing to put her money at risk. By undertaking which of the following simultaneous investment actions for her own portfolio would O'Neil most likely be in violation of Standard VI (B) Priority of Transactions?

-

Christina Ng, a Level I CFA candidate, defaulted on a bank loan she obtained to pay for her Master's degree tuition when her wedding cost more than expected. A micro finance loan company lent her money to pay off the tuition loan in full, including penalties and interest. The micro finance loan company even extended further credit to pay for her parents' outstanding medical bills. Unfortunately, her parents' health problems escalated to the point where Ng had to take extensive time away from work to deal with the issues. She was subsequently fired and consequently defaulted on the second loan. Because she was no longer employed, Ng decided to file for personal bankruptcy. Do the loan defaults leading up to Ng's bankruptcy most likelyviolate Standard I (D) Misconduct?

-

Charles Mbuwanga, a Level III CFA Candidate, is the business development manager for Sokoza Investment Group, an investment management firm with high-net-worth retail clients throughout Africa. Sokoza introduced listed Kenyan Real Estate Investment Trusts (REITs) to its line of investment products based on new regulations introduced in Kenya so as to diversify its product offering to clients. The product introduction comes after months of researching Kenyan property correlations with other property markets and asset classes in Africa. Sokoza assigns Mbuwanga as part of the sales team in introducing this product to its clients across Africa. Mbuwanga subsequently determines most of Sokoza's clients' portfolios would benefit from having a small Kenyan property exposure to help diversify their investment portfolios. By promoting the Kenyan REITs for Sokoza's client portfolios as planned, Mbuwanga would least likely violate which of the following standards?

-

Victoria Christchurch, CFA, is a management consultant currently working with a financial services firm interested in curtailing its high staff turnover, particularly amongst CFA charter-holders. In recent months, the company lost 5 of its 10 most senior managers, all of whom have cited systemic unethical business practices as the reason for their leaving. To curtail staff turnover by encouraging ethical behavior, it would be least appropriate for Christchurch to recommend the company do which of the following?

-

Henrietta Huerta, CFA, writes a weekly investment newsletter to market her services and obtain new asset management clients. A third party distributes the free newsletter on her behalf to those individuals on its mailing list. As a result, it is widely read by thousands of individual investors. The newsletter recommendations reflect most of Huerta's investment actions. After completing further research on East-West Coffee Roasters, Huerta decides to change her initial buy recommendation to a sell. To avoid violating the CFA Institute Standards of Professional Conduct it would be most appropriate for Huerta to distribute the new investment recommendation to:

-

Danielle Deschutes, CFA, is a portfolio manager who is part of a 10-person team that manages equity portfolios for institutional clients. A competing firm, South West Managers, asks Deschutes to interview for a position within its firm and to bring her performance history to the interview. Deschutes receives written permission from her current employer to bring the performance history of the stock portfolio with her. At the interview, she discloses that the performance numbers represent the work of her team and describes the role of each member.

To bolster her credibility, Deschutes also provides the names of institutional clients and related assets constituting the portfolio. During her interview Deschutes most likely violated the CFA Institute Standards of Professional Conduct with regards to:

-

When Abdullah Younis, CFA, was hired as a portfolio manager at an asset management firm two years ago, he was told he could allocate his work hours as he saw fit. At that time, Younis served on the board of three non-public golf equipment companies and managed a pooled investment fund for several members of his immediate family. Younis was not compensated for his board service or for managing the pooled fund. Younis' investment returns attract interest from friends and co-workers who persuade him to include their assets in his investment pool. Younis recently retired from all board responsibilities and now spends more than 80% of his time managing the investment pool for which he charges non-family members a management fee. Younis has never told his employer about any of these activities. To comply with the CFA Institute Standards of Professional Conduct with regards to his business activities over the past two years, Younis would least likely be required to disclose which of the following to his employer?

-

Kim Klausner, CFA, monitors several hundred employees as head of compliance for a large investment advisory firm. Klausner has always ensured that his company's compliance program met or exceeded those of its competitors. Klausner, who is going on a long vacation, has delegated his supervisory responsibilities to Sue Chang. Klausner informs Chang that her responsibilities include detecting and preventing violations of any capital market rules and regulations, and the CFA Institute Code and Standards. Klausner least likely violated the CFA

Institute Standards of Professional Conduct by failing to instruct Chang to also consider:

-

Sheila Schleif, CFA, is an equity analyst at an investment banking division of Mokara Financial Group, a full service financial group. Schleif uses a multi-factor computer model to make stock recommendations for all clients of Mokara. Schleif discovers the model contains an error. If the error were corrected, her most recent buy recommendation communicated to all clients would change to a sell. Schleif corrects the error, changing the buy to a sell recommendation, and then simultaneously distributes via e-mail the revision to all investment banking clients who received the initial recommendation. A week later, Schleif sells the same shares she held in her personal portfolio. Concerning her actions, Schleif most likely violated which of the following CFA Institute Standards of Professional Conduct?

-

Rodney Rodrigues, CFA, is responsible for identifying professionals to manage specific asset classes for his firm. In selecting external advisers or sub advisers, Rodrigues reviews the adviser's investment process, established code of ethics, the quality of the published return information, and the compliance and the integrated control framework of the organization. In completing his review, Rodrigues most likely violated the CFA Institute Standards of Professional Conduct with regards to his due diligence on:

-

Jackson Barnes, CFA, works for an insurance company providing financial planning services to clients for a fee. Barnes has developed a network of specialists, including accountants, lawyers, and brokers who contribute their expertise to the financial planning process. Each of the specialists is an independent contractor. Each contractor bills Barnes separately for the work he or she performs, providing a discount based upon the number of clients Barnes has referred. What steps should Barnes take to be consistent with the CFA Institute Standards of Professional Conduct?

-

Millicent Plain has just finished taking Level II of the CFA examination. Upon leaving the examination site, she meets with four Level III candidates who also just sat for their exams. Curious about their examination experience, Plain asks the candidates how difficult the Level III exam was and how they did on it. The candidates say the essay portion of the examination was much harder than they had expected and they were not able to complete all questions as a result. The candidates go on to tell Plain about broad topic areas that were tested and complain about specific formulas they had memorized what did not appear on the exam. The Level III candidates least likely violated the CFA Institute Standards of Professional Conduct by discussing:

-

On a flight to Europe, Romy Haas, CFA, strikes up a conversation with a fellow passenger, Vincent Trujillo. When Trujillo learns Haas is in the investment profession, he asks about the CFA designation. Haas tells him the following about the CFA designation:

Statement 1: Individuals who have completed the CFA Program have the right to use the CFA designation.

Statement 2: The CFA designation is globally recognized which is why I use it as part of my firm's name

Statement 3: CFA charter-holders must satisfy membership requirements to continue using the designation.

In explaining the use of the CFA designation, Haas least likely violated the CFA Institute Standards of Professional Conduct concerning which of the following statements?

-

The nominal (quoted) annual interest rate on an automobile loan is 10%. The effective annual rate of the loan is 10.47%. The frequency of compounding periods per year for the loan is closest to:

-

Equity return series are best described as, for the most part:

-

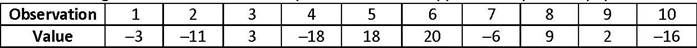

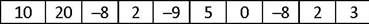

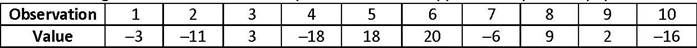

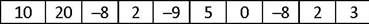

The following 10 observations are a sample drawn from an approximately normal population:

The sample standard deviation is closest to:

-

Event X and event Y are independent events. The probability of X is 0.2 [P(X) = 0.2] and the probability of Y is 0.5 [P(Y) = 0.5]. The joint probability of X and Y [P(X, Y] is closest to:

-

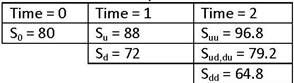

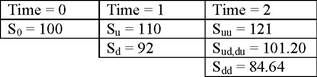

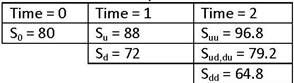

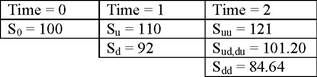

Assume that a stock's price over the next two periods is as shown below.

The initial value of the stock is $80. The probability of an up move in any given period is 75% and the probability of a down move in any given period is 25%. Using the binomial model, the probability that the stock's price will be $79.20 at the end of two periods is closest to:

-

Which of the following statements of null and alternative hypotheses requires a two-tailed test?

-

A stock is declining in price and reaches a price range wherein buying activity is sufficient to stop the decline. This is best described as a:

-

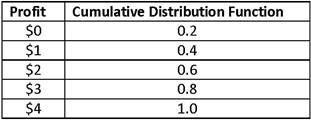

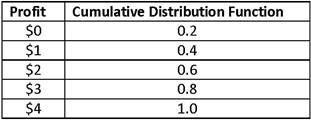

You are given the following discrete uniform probability distribution of gross profits from purchase of an option:

The probability of a profit greater than or equal to $1 and less than or equal to $4 is closest to:

-

A sample of 240 managed portfolios has a mean annual return of 0.11 and a standard deviation of returns of 0.23. The estimate of the standard error of the sample mean is closest to:

-

An analyst wants to estimate the return on the S&P 500 Index for the current year using the following data and assumptions:

·Sample size = 50 securities from the index

·Mean return for those stocks in the sample for the previous year = 0.114

·Variance = 0.0529

·The reliability factor for a 95% confidence interval with unknown population variance and sample size greater than 30 is

If he assumes that the S&P return this year will be the same as it was last year, which of the following is the best estimate of the 95% confidence interval for this year's S&P return?

-

The liquidity premium can be best described as compensation to investors for the:

-

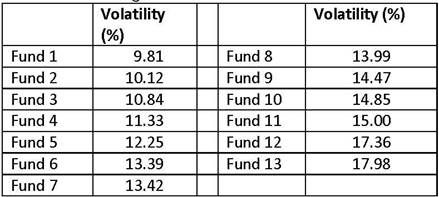

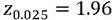

The following table shows the volatility of a series of funds that belong to the same peer group, ranked in ascending order:

The value of the first quintile is closest to:

-

The most recent returns of a fund are as follow:

The mean absolute deviation of returns for the fund is closest to:

-

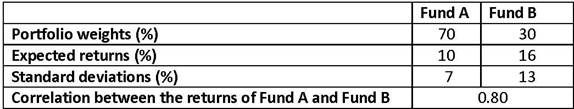

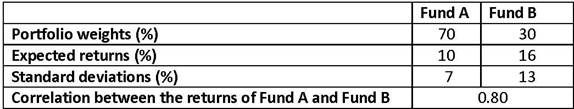

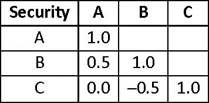

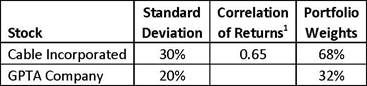

Consider the following information in relation to a portfolio composed of Fund A and Fund B:

The portfolio standard deviation of returns is closest to:

-

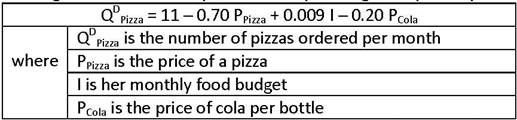

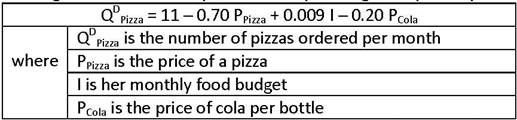

A college student's monthly demand for pizza is given by the equation:

The student's current monthly food budget is $500, the price of a pizza is $5 and the price of cola is $1.25/bottle. If the student's monthly food budget were to increase to $700, the slope of her demand curve for pizza would be closest to:

-

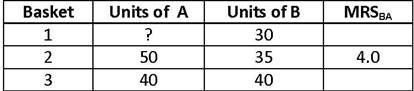

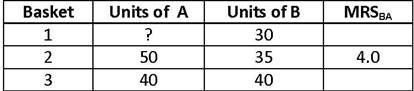

Partial information on three baskets containing goods A and B is given in the table below. The marginal rate of substitution of B for A, (MRSBA), at Basket 2 is also provided.

A consumer's indifference curves are strictly convex and he claims that he is indifferent between Baskets 2 and 3. If he is also indifferent between Baskets 1 and 3, the number of units of A in basket 1 is most likely:

-

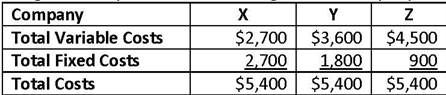

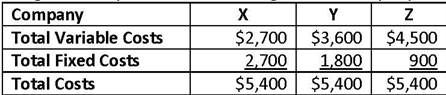

Three firms operate under perfect competition, producing 900 units of the same product but using different production technologies. Each company's cost structure is indicated below:

Which of the following statements is most accurate? If the unit selling price is:

-

The following data pertain to the total output in units and average selling prices in an economy that produces only two products, X and Y:

If the implicit price deflator for GDP in 2011 was 100, for 2012 it is closest to:

-

Which of the following would be most useful as a leading indicator to signal the start of an economic recovery?

-

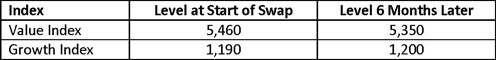

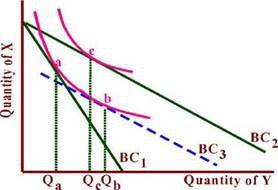

The diagram to the right shows the domestic demand and supply curves for a country that imports a commodity, where PW is its world price and PT is its domestic price after the imposition of a tariff. The reduction in the net national welfare of this country as a result of the tariff is best described by the area(s):

-

The International Bank for Reconstruction and Development most likely:

-

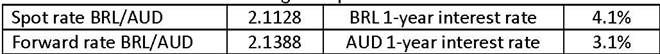

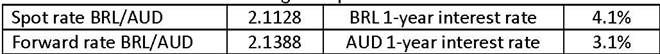

An investor examines the following rate quotes for the Brazilian real and the Australian dollar:

If the investor shorts BRL500,000 he will achieve a risk-free arbitrage profit (in BRL) closest to:

-

The demand and supply functions for a leading smart phone are furnished below:

Qdsp= 1,000 – 20Psp+ 2I; Qssp= –200 + 50Psp– 80W; where,

Qdsp = Quantity demanded in number of units

Qssp = Quantity supplied in number of units

Psp= Price per smart phone in $

I = Household income in $ per year

W = Wage rate in $ per hour

Currently, the firm has priced the smart phone at $250 per unit. If the wage is $10 per hour and the household income is $9,500 per year, the smart phone's equilibrium price is closest to:

-

A firm in a perfectly competitive environment has its total costs equal to total revenue and marginal costs greater than marginal revenue. Given this, which of the following strategies is most appropriate? The firm should:

-

The following data are for a basket of three consumption goods used to measure the rate of inflation:

Using the consumption basket for August 2011, the Paasche index is closest to:

-

Which of the following is most consistent with real business cycle (RBC) models? The arguments and recommendations of RBC models suggest that:

-

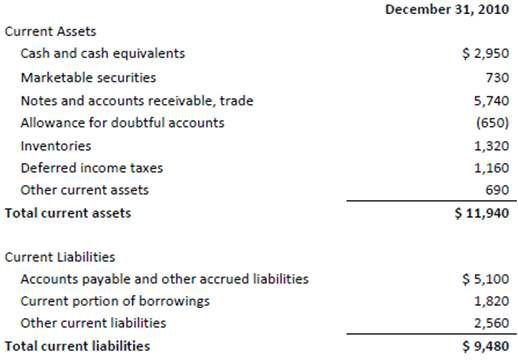

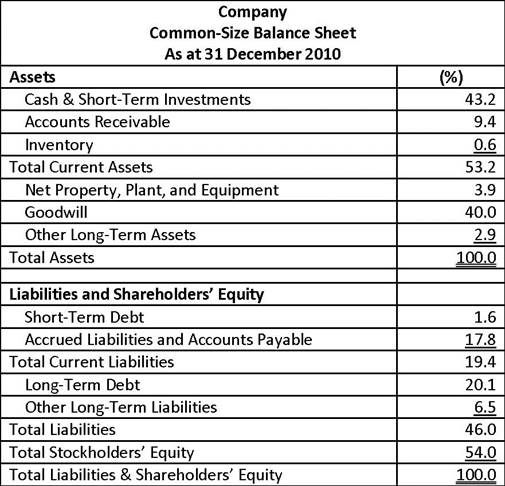

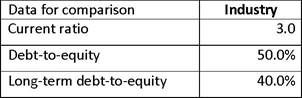

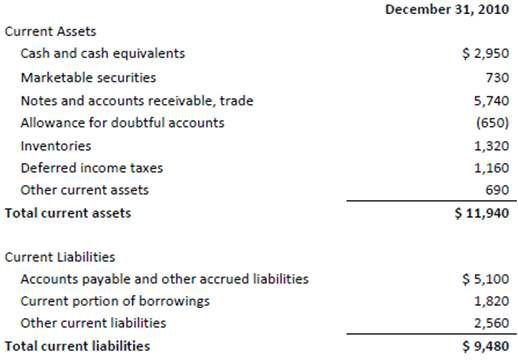

The current ratio for an industry is 3.2. Data for a firm in the industry is presented below:

Using the current ratio, when compared with the industry, the firm is best described as being:

-

A company operating in a highly fragmented and competitive industry reported an increase in ROE over the prior year. Which of the following reasons for the increase in ROE is least likely to be sustainable? The company:

-

In 2011, a software company recorded unearned revenue related to a software license that it will recognize as revenue during 2012. Ignoring income taxes, this recognition of the software revenue will most likely have which of the following effects on cash from operations in 2012?

-

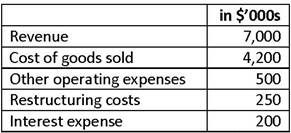

The following information for the current year is available for a company that prepares its financial statements in accordance with U.S. GAAP.

The company's operating profit (in $000s) is closest to:

-

Which of the following activities would an analyst least likely complete as part of the processing data phase of a financial analysis?

-

Which of the following reports is least likely to be filed with the SEC?

-

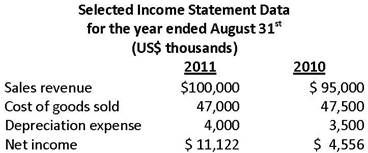

An analyst is forecasting gross profit of the three following companies. He uses the five-year average gross margins and forecasts sales using an internal model.

·Company 1's products currently enjoy healthy margins because of its technological edge. New technologies typically replace old ones every two years in this industry.

·Company 2 has been offering the same products throughout the period, and the demand and cost structures for its products have not experienced any significant changes.

·Company 3 has recently restructured its product offerings focusing on high margin products only.

For which of the three companies will the forecast of gross profit be most reliable? Company:

-

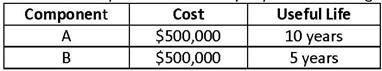

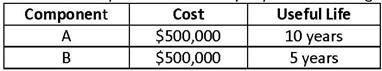

A company whose objective is to maximize income had spent $1,000,000 for a machine with two significant components as indicated below. The machine is expected to have an overall useful life of 10 years and the company uses the straight line method of depreciation.

The depreciation expense for the first year computed under IFRS compared with under U.S. GAAP will most likely be:

-

Dividends received are most likely classified as which type of cash flow under both IFRS and U.S.GAAP?

-

The following selected data are available for a firm:

If the firm's tax rate is 40%, the free cash flow to the firm (FCFF) is closest to:

-

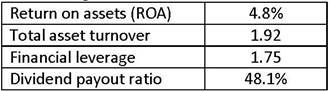

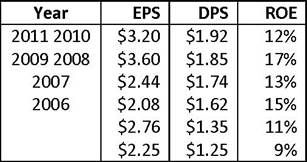

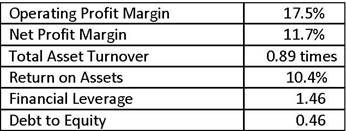

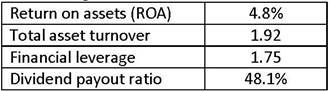

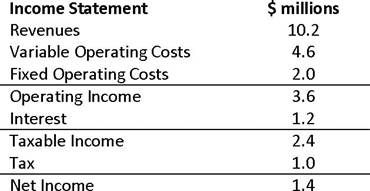

The following financial data is available for a company:

The company's sustainable growth rate is closest to:

-

During a period of rising inventory costs, a company decides to change its inventory method from FIFO to the weighted average cost method. Which of the following financial ratios will most likely increase as a result of this change?

-

Information about a company's planned capital expenditures is most likely found in the:

-

The following information is available about a company:

Total liabilities at the end of the year are closest to:

-

According to the International Accounting Standards Board's Conceptual Framework for Financial Reporting, the two fundamental qualitative characteristics that make financial information useful are best described as:

-

Which of the following statements about balance sheets is most accurate? Under:

-

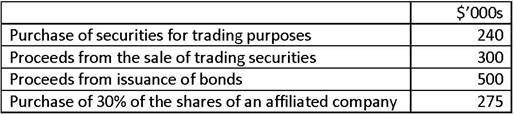

A company recorded the following events in 2012:

On the 2012 statement of cash flows, the company's net cash flow from investing activities (in $‘000s) is closest to:

-

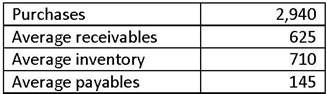

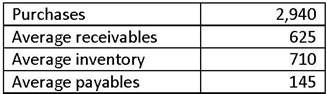

Selected information for a company is provided below.

The company's cash conversion cycle (in days) is closest to:

-

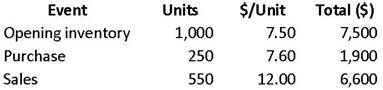

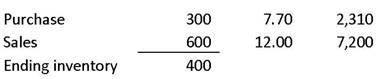

Select information from a company that uses the FIFO inventory method is provided below.

If the company used a perpetual system versus a periodic inventory system, the gross margin would most likely be:

-

A company, which prepares its financial statements according to IFRS, owns several investment properties on which it earns rental income. It values the properties using the fair value model based on prevailing rental markets. After two years of increases the market softened in 2012 and values decreased. A summary of the properties' valuations is as follows:

·Original cost (acquired in 2010) €50.0 million

·Fair value valuation as at December 31, 2010 €50.5 million

·Fair value valuation as at December 31, 2011 €54.5 million

·Fair value valuation as at December 31, 2012 €48.0 million

Which of the following best describes the impact of the revaluation on the 2012 financial statements?

-

Which of the following statements most accurately describes a valuation allowance for deferred taxes? A valuation allowance is required under:

-

An analyst can most accurately identify a LIFO liquidation by observing a(n):

-

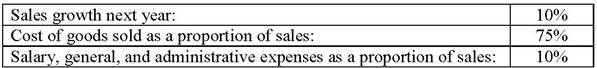

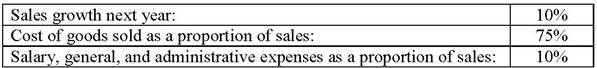

Selected information about a company is as follows:

The forecasted net income (in ‘000s) for 2012 is closest to:

-

If a company chooses to capitalize an expenditure related to capital assets instead of expensing it, ignoring taxes, the company will most likely report:

-

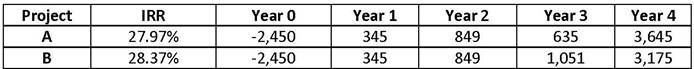

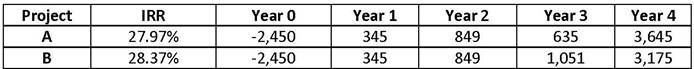

Two mutually exclusive projects have the following cash flows (€) and internal rates of return (IRR):

Assuming a discount rate of 8% annually for both projects, the firm should most likely accept:

-

A company's asset beta is 1.2 based on a debt-to-equity ratio of 50%. If the company's tax rate increases, the associated equity beta will most likely:

-

Which date in the chronology of a dividend payment is most likely determined by Securities Exchange? The:

-

A firm's price-to-earnings ratio (P/E) is 12.5. The firm has decided to repurchase shares using external funds that have an after-tax cost of 9%. After the repurchase, the earnings per share (EPS) will most likely:

-

Which is most likely considered a “pull” on liquidity?

-

Based on best practices in corporate governance procedures, independent board members most likely:

-

The unit contribution margin for a product is $12. Assuming fixed costs of $12,000, interest costs of $3,000, and a tax rate of 40%, the operating breakeven point (in units) is closest to:

-

The effective annualized cost (%) of a banker's acceptance that has an all-inclusive annual rate of 5.25% for a one-month loan of $2,000,000 is closest to:

-

Which of the following is most consistent with the best practices of corporate governance?

-

Which of the following is the least appropriate method for an external analyst to estimate a company's target capital structure for determining WACC? Using the:

-

Which of the following statements concerning regulatory bodies is least accurate? Regulatory bodies:

-

A company has initiated the process of selling unproductive land representing 5% of its total assets and using the proceeds to buy back its common shares. Holding other factors constant, these actions by the company will most likely result in a:

-

Which of the following is the most appropriate reason for using a free-cash-flow-to-equity (FCFE) model to value equity of a company?

-

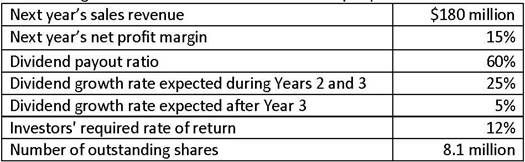

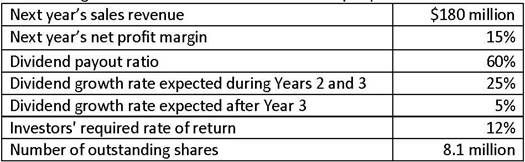

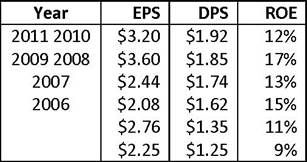

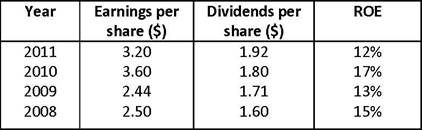

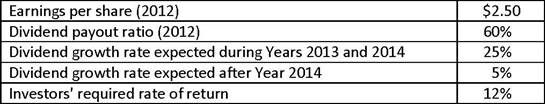

The following information is available about a company:

The current value per share of the company's common stock according to the two-stage dividend discount model is closest to:

-

A trader buys 500 shares of a stock on margin at $36 a share using an initial leverage ratio of 1.66. The maintenance margin requirement for the position is 30 percent. The stock price at which the margin call will occur is closest to:

-

Which of the following financial intermediaries are most likely to provide liquidity service to their clients?

-

A trader places a limit order to buy shares at a price of $49.94 with the stock trading at a market bid price of $49.49 and the bid-ask spread of 0.7%. The order will most likely be filled at:

-

The financial systems that are operationally efficient are most likely characterized by:

-

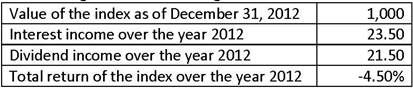

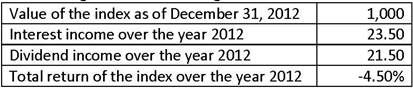

An investor gathers the following information for an index:

The value of the index as of January 1, 2012 is closest to:

-

After the public announcement of the merger of two firms an investor makes abnormal returns by going long on the target firm and short on the acquiring firm. This most likely violates which form of market efficiency?

-

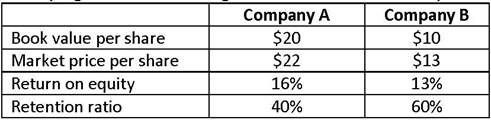

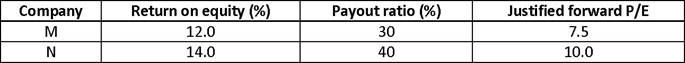

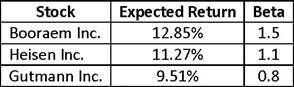

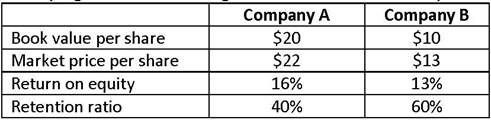

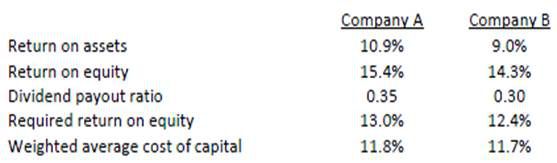

An analyst gathers the following information about two companies in the same industry:

What is the most appropriate conclusion regarding investors' expectations? Compared to Company B, Company A has:

-

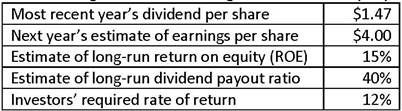

An investor gathers the following data about a company:

The company's justified forward P/E is closest to:

-

A corporation issues 5-year fixed-rate bonds. Its treasurer expects interest rates to decline for all maturities for at least the next year. She enters into a 1-year agreement with a bank to receive quarterly fixed-rate payments and to make payments based on floating rates benchmarked on 3-month LIBOR. This agreement is best described as a:

-

A portfolio manager is required to sell 31,250 shares of XYZ Inc. in two months. She is concerned the price of XYZ shares will decline during the 2-month period, so she enters into a deliverable equity forward contract to sell 31,250 shares of XYZ in two months for EUR 160 per share. When the contract expires, XYZ is trading at EUR 138 per share. The portfolio manager will most likely:

-

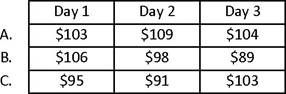

A trader takes a long position in 40 futures contracts on Day 1. The futures have a daily price limit of $5 and closes with a settlement price of $106. On Day 2, the futures trade at $111 and the bid and offer move to $113 and $115, respectively. The futures price remains at these price levels until the market closes. The marked-to-market amount the trader receives in his account at the end of Day 2 is closest to:

-

An investor is long an in-the-money American call option on a dividend paying stock. Would this option most likely ever be exercised early?

-

A European company issues a 5-year euro-denominated bond with a face value of EUR 50,000,000. The company then enters into a 5-year currency swap with a bank to convert the EUR exposure into USD exposure. The notional principals of the swap are EUR 50,000,000 and USD 70,000,000. The European company pays a fixed rate of 5% and the bank pays a fixed rate of 4.5%. Payments are made semiannually on a basis of 30 days per month and 360 days per year. What is the payment from the bank to the company at the end of year 4?

-

An investor with $5000 to invest believes that the price of ABC Corp. stock will appreciate by $7 to $95 in two months. The two-month at-the-money put on one share of ABC stock costs $1.76, while the two-month at-the-money call costs $1.56. In order to profit from his view on ABC stock, he will most likely:

-

If a bond's issuer is required to retire a specified portion of the issue each year, the bond most likely:

-

One reason why the duration of a portfolio of bonds does not properly reflect that portfolio's yield curve risk is the duration measure:

-

Investor A's marginal tax rate is 45%, while Investor B's is 30%. Both investors are considering two bonds for inclusion in a taxable portfolio. One bond is tax-exempt with a yield of 4.50%, while the other is taxable with a yield of 6.30%. Which bond will each investor most likely choose?

-

The yield on a U.S. Treasury STRIPS security is also known as the Treasury:

-

Consider a 5-year option-free bond that is priced at a discount to par value. Assuming the

discount rate does not change, one year from now the value of the bond will most likely:

-

The market value of an 18-year zero-coupon bond with a maturity value of $1,000 discounted at a 12% annual interest rate with semi-annual compounding is closest to:

-

All else equal, the difference between the nominal spread and the Z-spread for a non-Treasury security will most likely be larger when the:

-

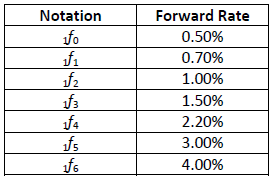

Assume the following six-month forward rates (presented on an annualized, bond-equivalent basis) were calculated from the yield curve.

The 3-year spot rate is closest to:

-

One advantage of the full valuation approach to measuring interest rate risk relative to the

duration/convexity approach is that the full valuation approach:

-

An analyst uses a valuation model to estimate the value of an option-free bond at 92.733 to yield 11%. If the value is 94.474 for a 60 basis point decrease in yield and 91.041 for a 60 basis point increase in yield, the effective duration of the bond is closest to:

-

Which of the following is least likely to be a type of embedded option in a bond issue granted to bondholders? The right to:

-

The bonds issued by ALS Corp. are currently priced at 108.00 and are option free. Based on a portfolio manager's valuation model, a 10 basis points rise in interest rates will result in the bond price falling to 106.50 while a 10 basis points fall in interest rates will result in the bond price rising to 110.00. The market value of the portfolio manager's holdings of ALS bonds is $2 million. The expected change in the market value of this holding for a 100 basis point change in interest rates will be closest to:

-

An alternative investments fund that employs leverage and takes long and short positions in securities is most likely a:

-

If an investor uses derivatives to make a long investment in commodities, the return earned on margin is best described as:

-

The most likely impact of adding commodities to a portfolio of equities and bonds is to:

-

The return on a commodity index is likely to be different from returns on the underlying commodities because:

-

Which of the following investments most likely provides an investor with indirect, equity exposure to real estate?

-

High Plains Capital is a hedge fund with a portfolio valued at $475,000,000 at the beginning of the year. One year later, the value of assets under management is $541,500,000. The hedge fund charges a 1.5% management fee based on the end-of-year portfolio value, and a 10% incentive fee. If the incentive fee and management fee are calculated independently, the effective return for a hedge fund investor is closest to:

-

Which of the following institutional investors are most likely to have a low tolerance for

investment risk and relatively high liquidity needs?

-

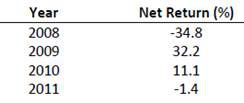

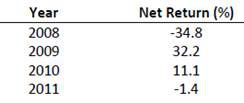

An asset management firm generated the following annual returns in their U.S. large cap equity portfolio:

The 2012 return needed to achieve a trailing five year geometric mean annualized return of 5.0% when calculated at the end of 2012 is closest to:

-

Consider a portfolio with two assets. Asset A comprises 25% of the portfolio and has a standard deviation of 17.9%. Asset B comprises 75% of the portfolio and has a standard deviation of 6.2%. If the correlation of these two investments is 0.5, the portfolio standard deviation is closest to:

-

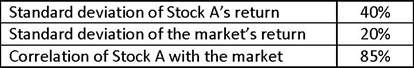

An asset has an annual return of 19.9%, standard deviation of returns of 18.5%, and correlation with the market of 0.9.

If the standard deviation of returns on the market is15.9% and the risk-free rate is 1%, the beta of this asset is closest to:

-

Which of the following performance measures most likely relies on systematic risk as opposed to total risk when calculating risk-adjusted return?

-

A financial advisor gathers the following information about a new client:

·The client is a successful economics professor at a major university

·The client plans to work full time for seven years and then will work part time for 3 years before retiring

·The client owns two homes and does not have any outstanding debt

·The client has accumulated retirement savings of approximately $ 2 million through their employer's retirement plan and will have anticipated retirement spending needs of $60,000 per year

·The client reads numerous financial publications and follows markets closely

·While concerned about the current health of the global economy, the client maintains that he is a long-term investor .

Based on the above information, which of the following best describes this client?

-

As a condition of his employment with an investment bank, Abasi Hasina, CFA, was required to sign an employment contract, including a non-compete clause restricting him from working for a competitor for three years after leaving the employer. After one year, Hasina quits his job for a comparable position with an investment bank in a country where non-compete clauses are illegal. Lawyers with whom he consulted prior to taking the new position determined the non-compete clause was a violation of human rights and thus illegal. Did Hasina most likely violate the CFA Institute Code of Ethics?

-

Benefits of compliance with the CFA Institute Global Investment Performance Standards (GIPSR)least likely include:

-

Who is most likely responsible for claiming and maintaining compliance with the CFA Institute Global Investment Performance Standards (GIPSY)?

-

Mariam Musa, CFA, head of compliance at Dunfield Brokers, questions her colleague Omar Kassim, a CFA candidate and a research analyst, about his purchase of shares in a company for his own account immediately before he publishes a "buy" recommendation. He defends his actions by stating he has done nothing wrong because Dunfield does not have any personal trading policies in place. The CFA Institute Code of Ethics and Standards of Professional Conduct were most likelyviolated by:

-

Zhao Xuan, CFA, is a sell side investment analyst. While at a software industry conference, Zhao hears rumors that Green Run Software may have falsified its financial results. When she returns to her office, Zhao conducts a thorough analysis of Green Run. Based on her research, including discussions with some of Green Run's customers, Zhao is convinced that Green Run's reported50% increase in net income during recent quarters is completely fictitious. So far, however, Zhao is the only analyst suspicious about Green Run's reported earnings. According to the CFA Institute Code of Ethics and Standards of Professional Conduct, the least appropriate action for Zhao is to:

-

Richard Cardinal, CFA, is the founder of Volcano Capital Research, an investment management firm whose sole activity is short selling. Cardinal seeks out companies whose stocks have had large price increases. Cardinal also pays several lobbying firms to update him immediately on any legislative or regulatory changes that may impact his target companies. Cardinal sells short those target companies he estimates are near the peak of their sales and earnings and that his sources identify as facing legal or regulatory challenges. Immediately after he sells a stock, Cardinal conducts a public relations campaign to disclose all of the negative information he has gathered on the company, even if the information is not yet public. Which of Cardinal's following actions is least likely to be in violation of the CFA Institute Standards of Professional Conduct?

-