单选题

编号:2695626

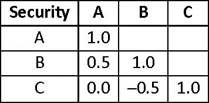

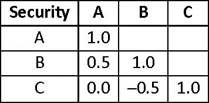

1. A correlation matrix of the returns for securities A, B, and C is reported below:

Assuming that the expected return and the standard deviation of each security are the same, a portfolio consisting of an equal allocation of which two securities will be most effective for portfolio diversification? Securities:

Assuming that the expected return and the standard deviation of each security are the same, a portfolio consisting of an equal allocation of which two securities will be most effective for portfolio diversification? Securities: