单选题

编号:2695769

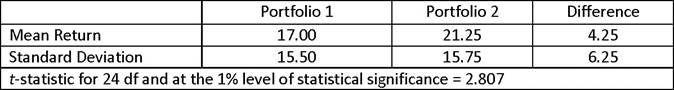

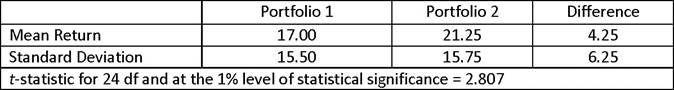

1.Using the sample results given below, drawn as 25 paired observations from their underlying distributions, test if the mean returns of the two portfolios differ from each other at the 1% level of statistical significance. Assume the underlying distributions of returns for each portfolio are normal and that their population variances are not known.

Based on the paired comparisons test of the two portfolios, the most appropriate conclusion is:

Based on the paired comparisons test of the two portfolios, the most appropriate conclusion is: