单选题

编号:2693909

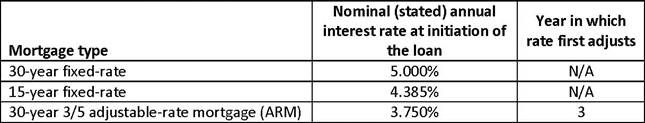

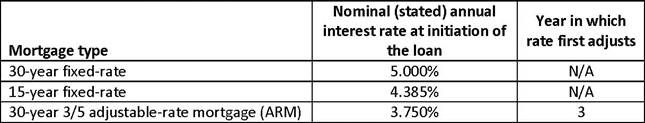

1.A borrower is considering three competing mortgage loan offers from her bank, The amount borrowed on the mortgage is $100,000 with monthlv compounding,

The rate on the ARM resets at the end of Year 3. Assuming the ARM is reset at 5.500% (i.e., the remaining balance on the loan will now be repaid with 5.500% nominal annual interest), which of the three loans will have the smallest monthly payment after the rate reset at the end of Year 3?

The rate on the ARM resets at the end of Year 3. Assuming the ARM is reset at 5.500% (i.e., the remaining balance on the loan will now be repaid with 5.500% nominal annual interest), which of the three loans will have the smallest monthly payment after the rate reset at the end of Year 3?