单选题

编号:2695598

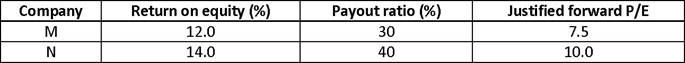

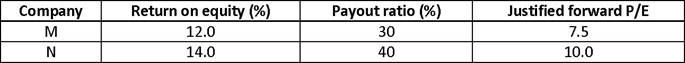

1. An analyst collects the following data on the return on equity (ROE) and the payout ratio for two companies, M and N. Using a required return of 12.4% for both companies, she computes the justified forward P/E ratios, which are also given below.

If Company M increases its dividend payout ratio to 40% and Company N decreases its dividend payout ratio to 30%, which of the following will most likely occur? The justified P/E ratio of:

If Company M increases its dividend payout ratio to 40% and Company N decreases its dividend payout ratio to 30%, which of the following will most likely occur? The justified P/E ratio of: