单选题

编号:2695968

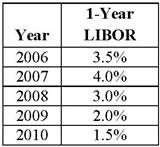

1. A 5-year floating-rate security was issued on January 1, 2006. The coupon rate formula was 1-year LIBOR + 300 bps with a cap of 10% and a floor of 5% and annual reset. The 1-year LIBOR rate on January 1st of each year of the security's life is provided in the following table:

During 2010, the payments owed by the issuer were based on a coupon rate closest to:

During 2010, the payments owed by the issuer were based on a coupon rate closest to: