单选题

编号:2695815

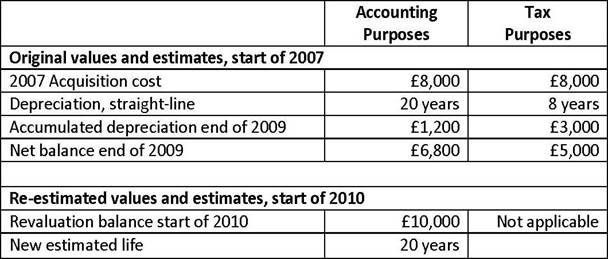

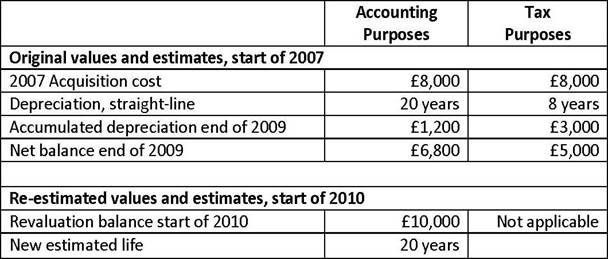

1. A company has recently revalued one of its depreciable properties and estimated that its remaining useful life would be another 20 years. The applicable tax rate for all years is 30% and he revaluation of the property is not recognized for tax purposes. Details related to this asset are provided in the table below, with all f-values in millions.

The deferred tax liability (in millions) as at the end of 2010 is closest to:

The deferred tax liability (in millions) as at the end of 2010 is closest to: