单选题

编号:2695742

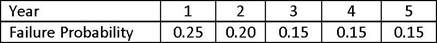

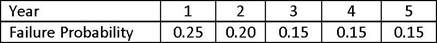

1. A project that requires an initial investment of €5 million is expected to pay €22 million at the end of five years if it is successful. The probabilities of failure for the project are provided below:

Assuming the cost of capital for the project is 16%, the project's expected net present value is closest to:

Assuming the cost of capital for the project is 16%, the project's expected net present value is closest to: