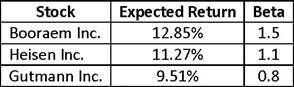

1. Information about three stocks is provided below:

If the expected market return is 9.5% and the average risk-free rate is 1.2%, according to the capital asset pricing model (CAPM) and the security market line (SML), which of the three stocks is most likely overvalued?