单选题

编号:2695392

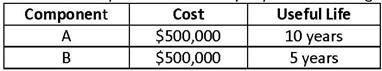

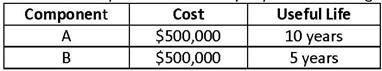

1. A company whose objective is to maximize income had spent $1,000,000 for a machine with two significant components as indicated below. The machine is expected to have an overall useful life of 10 years and the company uses the straight line method of depreciation.

The depreciation expense for the first year computed under IFRS compared with under U.S. GAAP will most likely be:

The depreciation expense for the first year computed under IFRS compared with under U.S. GAAP will most likely be: