单选题

编号:2695591

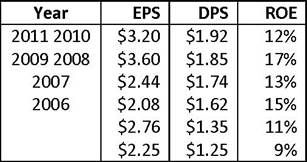

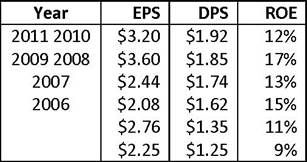

1. An investor uses the data below and Gordon's constant growth dividend discount model to evaluate a company's common stock. To estimate growth, she uses the average value of the:

1) compounded annual growth rate over the period 2006-2011 and

2) sustainable growth rate for the year 2011.

If her required return is 15%, the stock's intrinsic value is closest to:

1) compounded annual growth rate over the period 2006-2011 and

2) sustainable growth rate for the year 2011.

If her required return is 15%, the stock's intrinsic value is closest to: