单选题

编号:2695183

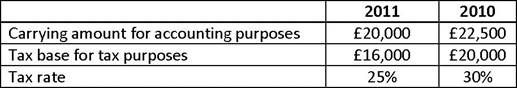

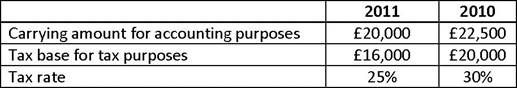

1. A company purchased equipment in 2010 for £25,000. The year-end values of the equipment for accounting purposes and tax purposes are as follows:

Which of the following statements best describes the effect of the change in the tax rate on the company's 2011 financial statements? The deferred tax liability:

Which of the following statements best describes the effect of the change in the tax rate on the company's 2011 financial statements? The deferred tax liability: